Argentina cuts export taxes on key farm products

Permanent reductions welcomed but sector pushes for moreOn July 27, the Argentine government implemented permanent reductions in export taxes for several major agricultural products, according to a recent USDA Foreign Agricultural Service report.

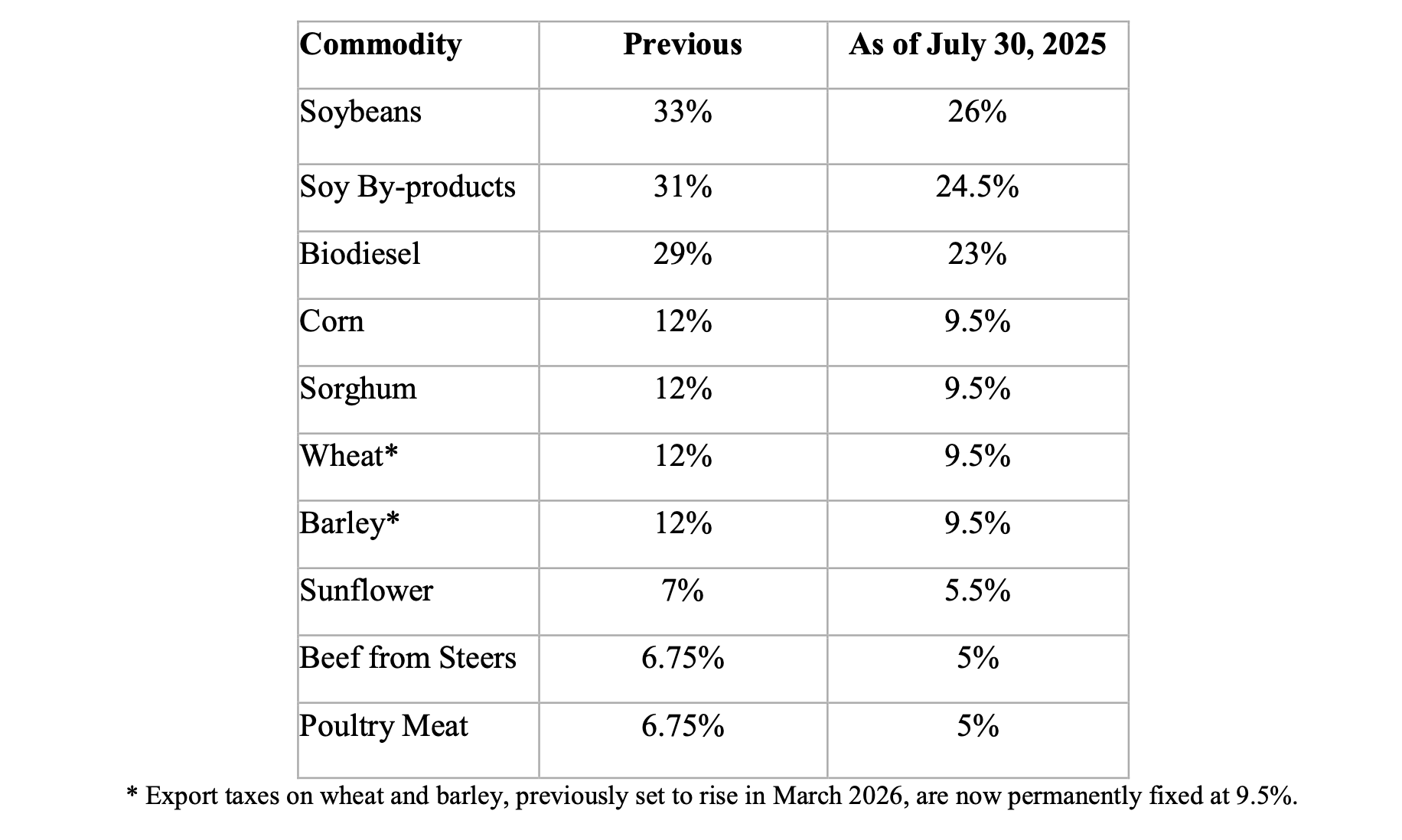

The soybean rate was lowered from 33% to 26%, corn and sorghum from 12% to 9.5%, and soybean by-products from 31% to 24.5%. Unlike previous temporary cuts, these changes take effect immediately upon publication in the Official Bulletin to remain in place for the duration of the current administration and represent a lasting policy shift.

While the reductions were welcomed by the agricultural sector, industry groups continue to advocate for deeper or total elimination of export taxes. The impact on production and exports is expected to be limited in the short to medium term.

On July 27, President Javier Milei announced a permanent reduction in export taxes on key agricultural products during his address at the 137th Expo La Rural, the largest livestock and agricultural event in the country, organized by the Sociedad Rural Argentina in Buenos Aires.

The reductions apply to a broad range of agricultural exports, including grains, oilseeds, processed oilseed products, poultry, and beef. According to the announcement, these measures. Despite previous temporary reductions in some export taxes, this is the first time such cuts have been made permanent. The lower tax rates will remain in place for the duration of President Milei’s administration but a change of parties in future administrations could reverse the cuts. The current rates as published in the Official Bulletin are as follows:

In addition, the government made permanent the current 9.5% export tax rates on wheat and barley, which were previously scheduled to return to 12% in March 2026.

President Milei attributed the tax reductions to the government’s recently achieved fiscal surplus following years of macroeconomic instability characterized by multiple exchange rates, high inflation, capital controls, and burdensome regulations.

The announcement comes amid mounting pressure from agricultural producers, who are facing tight or negative margins due to weak global commodity prices and persistently high domestic production costs in US dollar terms. Producer associations have long argued that export taxes, known locally as retenciones, reduce competitiveness and discourage investment.

The sector has largely welcomed the reductions as a positive step, though many continue to advocate for the complete elimination of export taxes in the short to medium term.

Post expects the measures to improve farm and ranch profitability, as producers will retain the revenue previously paid in export taxes on the affected commodities listed in the table above. However, given current market conditions, they are unlikely to result in a significant increase in overall grain or livestock production in the near term.