Global ag trade remains fairly steady, but uncertain through pandemic

Between a global pandemic and politically turbulent climate, livestock industries have eagerly looked toward international policies and trade.Now that 2020 has nearly come to an end, specialists in policy, trade and economics can evaluate trends and offer a future outlook, writes Jaclyn Krymowski for Global Ag Media.

As part of the virtual Agriculture Policy and Outlook Conference put on by The Ohio State University College of Food, Agriculture and Environmental Sciences, Dr. Ian Sheldon, professor and Andersons Chair of Agricultural Marketing, Trade and Policy at Ohio State, addressed some of these concerns.

2020 Overview

In April 2020, the World Trade Organization (WTO) estimated global trade would be impacted between 13% to 32% due to the pandemic. Fortunately, neither of those were the case. The current WTO forecast is for total 2020 global trade decline to be only about 9.2% with an anticipated rise next year.

Without the pandemic, economists were expecting trade to remain consistent on its steady tick up. Fortunately, the largest impact of the pandemic happened fairly immediately from March to May then a slow recovery began.

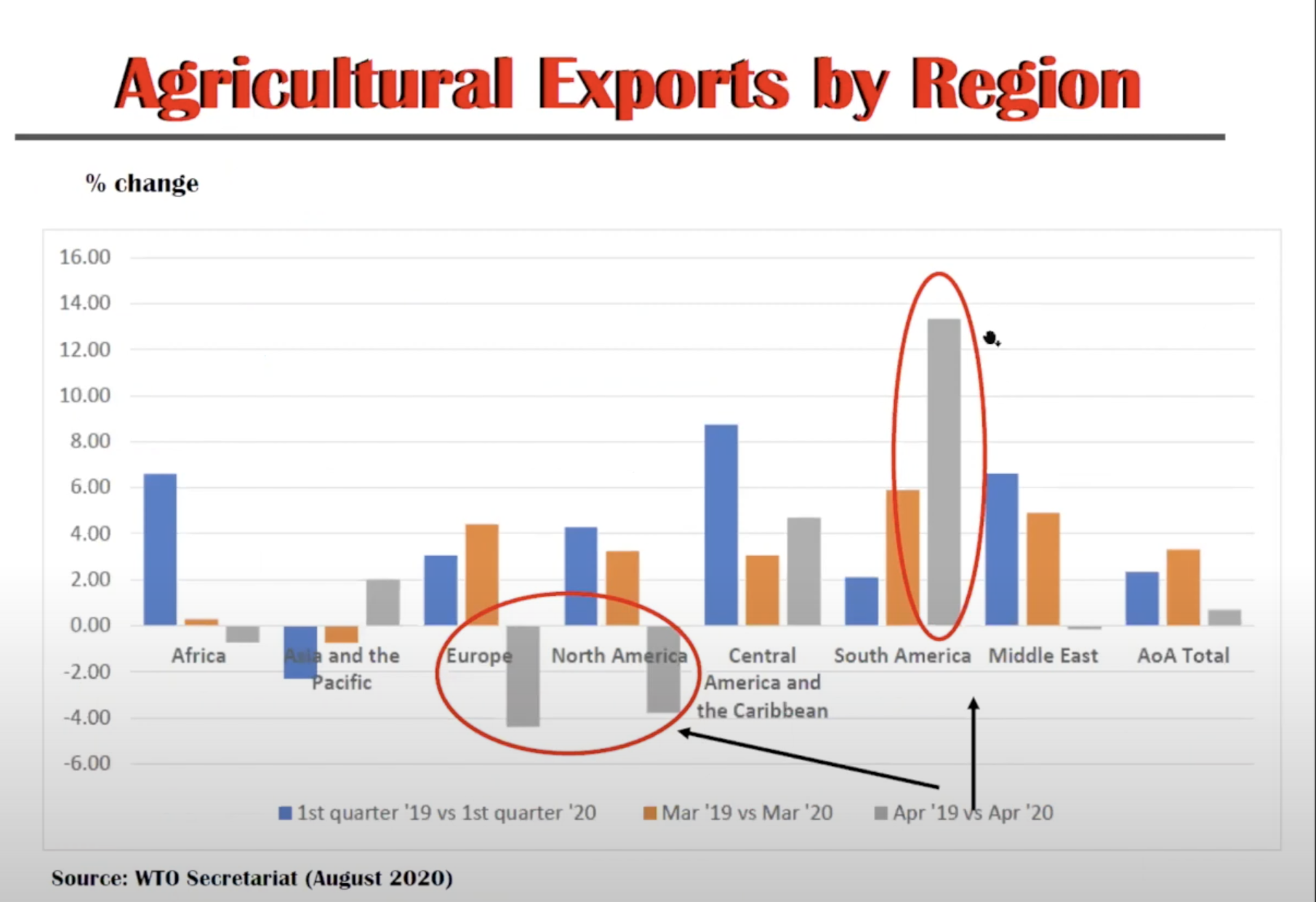

© I. Sheldon, The Ohio State University

“There's still a considerable amount of uncertainty about the trajectory of trade for the rest of 2020 into 2021,” Sheldon explained. “Especially now, we're observing a resurgence of COVID-19 both here in North America and in Europe.”

Currently, WTO estimates trade to rebound by 7.2% in 2021, allowing for variations in exports and imports of various nations. For example, North American imports saw an 8.7% decline this year but are anticipated to rebound 6.7% in 2021.

Government impact

World governments play a key role in how global trade will continue to play out moving forward. Ongoing lockdowns could have a significant negative impact on gross domestic product (GDP) moving into 2021.

“It's very important to realize that macroeconomic policy here in the U.S., in the European Union and elsewhere is pretty critical to mitigating the impact of the pandemic, both on trade and changes in GDP,” said Sheldon. “Trade policy is going to be critical as we come out the other side of the pandemic.”

© I. Sheldon, The Ohio State University

Another factor in the hands of government is how funds will be spent. Spending on foreign policy and unemployment rates alone could reduce trade by up to 4%.

The release of a vaccine will be another big factor in global trade. By simply boosting confidence, this could raise GDP growth by 1% to 2% and global trade by 3% in 2021, according to Sheldon.

An unexpected impact could come from the advent of webinar technology. This could be a positive moving forward, creating a more connected global trade system.

Then, now and the future

Early in the year, the WTO and Food and Agriculture Organization (FAO) expressed concern about a negative impact on international agriculture trade due to export restrictions and stockpiling. Fortunately, both scenarios came to pass very quickly. In fact, agricultural trade proved to be resilient with global exports rising by 2%.

“Food is essential to humans,” Sheldon said explaining these numbers. “Economists talk about the demand for food as relatively income inelastic.”

While the pandemic intensified already downward pressure on food prices, there is no evidence to suggest it will create a food security crisis. Globally, there seems to be enough foodstuffs available despite more families pushed to food insecurity in certain regions due to multiple factors.

Overall, the global trade forecast looks very positive both this year and for moving forward into 2021.

“The monthly data show that the change in exports and imports has not been that different from 2019,” said Sheldon.

Certain trade targets between nations and regions were down. For example, the US Phase One trade deal with China is 35% below its cumulative target. Sheldon said there is still an optimistic target for growth of imports by China.

With the US Biden administration coming in, Sheldon expects coalition with partners such as the EU and Japan to continue to set trade rules for China similar to the Trump administration. Differences might be more support for reforms to WTO rules.

“In terms of tariffs, I think we're most likely to see a more targeted use of tariffs with a specific focus where there's violation of trade rules by our trading partners,” he said, further noting a push to end EU tariffs on steel.

Overall, Sheldon and many experts are optimistic about trade moving forward.