US Beef Exports Stay Red-hot in July

US - US beef exports remained well above last year’s pace in July, posting one of the highest monthly export value totals on record, according to statistics released by USDA and compiled by USMEF.

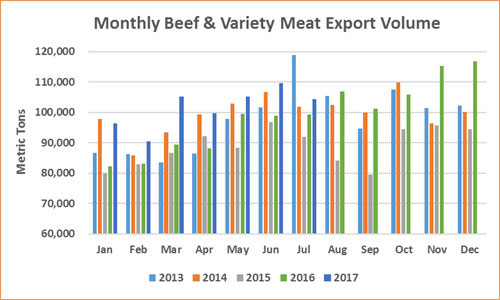

July beef exports totaled 104,488 metric tons (mt), up 5 per cent year-over-year, while export value reached $623.7 million – up 18 per cent from a year ago and the highest since December 2014. For January through July, exports increased 11 per cent in volume (711,364 mt) and 15 per cent in value ($3.97 billion) compared to the first seven months of last year.

Exports accounted for 13.2 per cent of total US beef production in July and 10.7 per cent for muscle cuts only. These were the highest ratios of 2017, but down from 14.2 per cent and 11 per cent, respectively, last July.

For January through July, beef exports accounted for 12.8 per cent of total production and 10 per cent for muscle cuts – roughly steady with last year. Export value per head of fed slaughter averaged $299.21 in July, up more than $35 (or 13 per cent) from a year ago. Through July, per-head export value was up 9 per cent to $273.52.

"July was certainly a solid month, especially for beef exports, but these results remind us that the US red meat industry operates in an intensely competitive global environment," said USMEF CEO Philip Seng.

"At a time when some of our most essential trade agreements are under review, we must be mindful of how these agreements have helped make US beef, pork and lamb more readily available and more affordable for millions of global customers, to the benefit of US producers and everyone in the US supply chain."

Beef export volume to Japan largest in four years; value highest of post-BSE era

Beef exports to leading market Japan totaled 27,689 mt in July, up 20 per cent from a year ago and the largest since July 2013 – which was shortly after Japan increased the eligible US cattle age to 30 months. July export value to Japan increased 36 per cent to $175.7 million, the highest monthly total since 1996.

For January through July, exports to Japan were up 23 per cent in volume (178,501 mt) and 29 per cent in value ($1.08 billion). USMEF’s featuring of chilled beef in Japan continues to pay dividends as chilled exports were up 39 per cent to 83,951 mt valued at $613 million (up 40 per cent).

Driven by strong growth in Japan’s foodservice industry, especially the gyudon beef bowl chains which heavily rely on US short plate, US frozen beef exports to Japan were up 12 per cent to 64,928 mt (valued at $250 million, up 18 per cent). But Japan’s frozen beef safeguard was triggered in late July, increasing the duty on frozen beef imports from suppliers without a trade agreement with Japan, including the US, from 38.5 per cent to 50 per cent.

The impact of the safeguard is not likely to surface until the September export data is available. But since August, US frozen beef has been at an even larger tariff disadvantage compared to Australian beef, which is subject to a duty rate of 27.2 per cent under the Japan-Australia Economic Partnership Agreement.

Beef exports to South Korea dipped below the large volume of last July to 15,587 mt (down 5 per cent), but were still the largest of 2017. July export value to Korea increased 8 per cent from a year ago to $101.7 million. Through July, exports to Korea increased 9 per cent in volume (98,944 mt) and 19 per cent in value ($629.4 million), including an impressive 83 per cent increase in chilled beef exports (22,432 mt) valued at $199 million (up 88 per cent).

The US is now the largest supplier of beef to both Japan and Korea on a value basis, with the US share of Korea’s imports increasing from 43 per cent to 48.5 per cent.

Other January-July highlights for US beef exports included:

- After a slow start in 2017, beef exports to Hong Kong continue to rebound. Exports were up 13 per cent year-over-year in volume (65,379 mt) and 21 per cent higher in value ($417.8 million). July was the first full month for exports to China, as exports totaled 137 mt valued at $1.3 million.

- Beef exports to Taiwan increased 16 per cent from a year ago in volume (24,234 mt) and 24 per cent in value ($215.5 million), including chilled beef exports of 9,883 mt (up 19 per cent) valued at $114 million (up 22 per cent). US beef holds more than 70 per cent of Taiwan’s chilled beef market, the highest share of any Asian destination.

- Led by strong growth in Chile, Peru and Colombia, beef exports to South America increased 20 per cent year-over-year in volume (16,159 mt) and 21 per cent in value ($63.2 million). Exports to Brazil, which launched in late April, reached 1,198 mt valued at $3.2 million.

- A strong performance in the Philippines, Indonesia and Vietnam fueled 79 per cent year-over-year growth in export volume to the ASEAN region (23,376 mt), with value up 59 per cent to $114.1 million. This region is especially strong for beef variety meat exports, as volume reached 7,145 mt (up 176 per cent) valued at $12.5 million (up 164 per cent).

- Within North America, beef exports were fairly steady with last year as Mexico continues to be the second-largest volume destination for US beef exports while Canada ranks fourth. Exports to Mexico increased 2 per cent in volume (134,543 mt) but slipped 2 per cent in value ($544.8). Exports to Canada were up 1 per cent in volume (68,097 mt) and 4 per cent in value ($475.7 million).

TheCattleSite News Desk