EU Beef Production Turns to Dairy Herd

EU - European beef production is to rely more and more on the dairy herd in future rather than suckler cows, changing the structure of the total EU herd significantly.The December 2014 EU herd survey shows the herd is 290,000 head down on 2010 numbers. At the same time the dairy herd has increased by about the same amount, according to the latest Short-Term Outlook for EU arable crops, dairy and meat markets in 2015 and 2016.

France and Spain have increased both their suckler and dairy herds.

Beef production figures show an increase of 2.5 per cent in EU beef production last year, with Poland increasing production by 77,000 tonnes, Ireland by 64,000 tonnes and the UK by 30,000 tonnes.

The report says that cow herd developments and export opportunities will drive EU beef production up in 2015.

In the first quarter of this year, beef production across the EU rose by 4.8 per cent, as a number of countries slaughtered dairy cows in a bid to restrict milk quota overshoot. This was particularly seen in Poland, Italy, Estonia, Austria, Latvia and Luxembourg.

Spanish beef production rose by 9.3 per cent in the first three months of the year with 12 per cent coming from cows and 17 per cent from bulls. The report says that his reflects the larger beef herd in the country.

In 2015, total EU beef production could rise further by 1.4 per cent, as EU production capacity has risen and because of the impact of the herd changes.

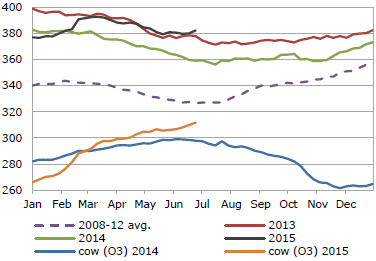

EU Beef Prices Trends Since 2008

Graph courtesy of the European Commission

Beef exports rose by 29 per cent or 46,000 tonnes last year, mainly because of an increase in exports to exports to Hong Kong, Western Balkans and the new market of the Philippines, one of the several new markets that have been sourced following the introduction of the Russian import ban.

EU beef exports are expected to reach 225,000 tonnes this year, an 8.5 per cent increase in 2014.

Live exports rose last year by 5.3 per cent with Lebanon being the major destination, taking 45 per cent of the exports.

This year, the first quarter is already showing a 35 per cent increase in live exports on last year.

The outlook report says that the opening of the Turkish market to beef and live cattle exports is offering further prospects for 2015.

Beef imports from Australia to the EU rose by 21 per cent and by three per cent from Brazil last year, while Argentine imports fell because of the government policy to focus on the domestic market.

However, with the decline in the Australian herd because of drought and with Brazil now concentrating on the Russian market, the amount of beef coming from these countries into the EU is expected to decline this year. A new free trade agreement between Australia and China could affect Australian export to the EU further.

The EU beef price reached €380/100 kg in June this year despite cow slaughter rising in the first quarter.

World prices are expected to to remain high because of tight supply, a temporary drop in the Australian production potential and high demand in the US and Asia, particularly as the US rebuilds its herd.