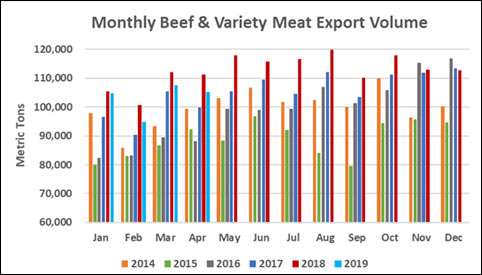

April Beef Export Below 2018 Levels

US - April exports of US beef were lower than a year ago, according to data released by USDA and compiled by USMEF.

Beef exports totaled 105,241 metric tons (mt) in April, down 5 percent year-over-year, though export value was down only slightly at $674.2 million.

For January through April, exports were 4 percent below last year’s record pace in volume (412,547 mt) and 1 percent lower in value ($2.58 billion).

On a per-head basis, beef export value per head of fed slaughter averaged $305.61 (down 7 percent from April 2018). The January-April average was $308.34 per head, down 3 percent from a year ago.

April exports accounted for 12.5 percent of total US beef production and 10.2 percent for muscle cuts only, down from 14.1 percent and 11.3 percent, respectively, a year ago.

For January through April, these ratios were 12.7 percent and 10.2 percent (down from 13.4 percent and 10.8 percent).

Beef demand strong in Korea and Taiwan; Japan edges lower

South Korea remains the export growth leader for US beef, with April volume up 18 percent to 22,584 mt. April value surged 22 percent to $164.3 million, surpassing Japan as the month’s leading value market.

January-April exports to Korea were 11 percent ahead of last year’s record pace in volume (78,757 mt) and climbed 15 percent higher in value ($578.5 million).

US share of Korea’s total beef imports climbed to 47.5 percent, up a full percentage point from last year. US share of Korea’s chilled beef imports reached 60 percent.

Taiwan is also coming off a record year for US beef exports and posted a strong April at 5,118 mt (up 15 percent from a year ago) valued at $47.9 million (up 14 percent).

Through April, exports to Taiwan totaled 18,605 mt (up 6 percent) valued at $165.6 million (down 2 percent).

In Japan, where all of US beef’s major competitors have gained tariff relief in 2019, April exports were down 6 percent from a year ago in both volume (24,149 mt) and value ($156.8 million).

Export volume through April was steady with last year’s pace at 98,296 mt while value increased 2 percent to $637.2 million.

US market share in Japan is still more than 41 percent, but this is down from nearly 45 percent in the first four months of 2017. For chilled beef, US share has slipped two percentage points to 47.4 percent.

In April, Japan’s imports from Mexico more than tripled year-over-year and imports also increased from Canada (up 52 percent), New Zealand (up 41 percent) and Australia (up 9 percent) as competitors of US beef benefited from lower tariff rates.

"US beef is holding its own in Japan, but the April numbers are telling," cautioned USMEF President and CEO Dan Halstrom.

"With the 1 April rate cut, Australian, Canadian, New Zealand and Mexican beef are now subject to a 26.6 percent duty while the rate for US beef remains at 38.5 percent. It is absolutely essential that the US secures an agreement that will level this playing field.

"US beef’s exceptional growth in Korea is a great example of what’s possible when tariffs are less of an obstacle."

Other January-April highlights for US beef include:

- Beef exports to Mexico continue to post strong results, especially for muscle cuts. Combined beef/beef variety meat exports through April were 2 percent below last year’s pace at 76,870 mt, but value increased 9 percent to $372.4 million. For muscle cuts only, exports to Mexico climbed 8 percent from a year ago in volume (47,379 mt) and 11 percent in value ($293.3 million).

- Strong growth in the Philippines fueled a 20 percent increase in beef exports to the ASEAN region as volume reached 17,770 mt, valued at $86.9 million (up 6 percent). Export volume also trended higher to Indonesia and Vietnam.

- An exceptional performance in the Dominican Republic is fueling a strong year for US beef in the Caribbean. Exports to the Dominican Republic soared 56 percent above last year’s pace in volume (3,068 mt) and 50 percent higher in value ($25 million). The Caribbean was up 16 percent in volume (9,826 mt) and 18 percent in value ($65.2 million) with exports also trending higher for Jamaica and the Bahamas.

- Exports to Hong Kong slipped 36 percent from a year ago in volume (27,825 mt) and were 29 percent lower in value ($236.6 million). Despite a 25 percent retaliatory duty, US beef exports to China increased 5 percent to 2,417 mt, but value was down 15 percent to $18.2 million as most of the tariff cost was borne by US suppliers. China’s beef imports already eclipsed $2 billion through the first four months of this year, up 54 percent from last year’s record pace, but the US holds less than 1 percent of China’s booming beef import market.

- Exports to Canada were down 15 percent in volume to 31,070 mt and 14 percent in value to just under $200 million. Demand has been impacted by larger Canadian beef production in 2019, but elimination of the 10 percent retaliatory duty on prepared beef products from the US will help exports in this important category rebound.

TheCattleSite News Desk