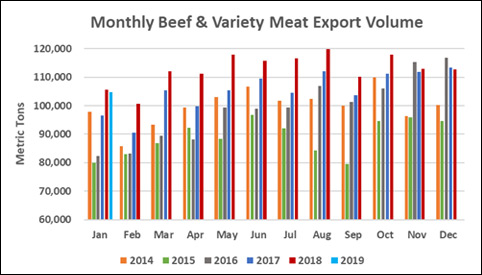

Red Meat Export Volume Fairly Steady in January

US - January exports of US beef and pork were slightly below last year’s volume levels while export value posted mixed results, according to statistics released by USDA and compiled by USMEF.

Beef exports slipped 1 percent year-over-year to 104,766 metric tons (mt), but value still increased 3 percent to $642.3 million. Export value per head of fed slaughter pulled back from the red-hot pace of 2018, averaging $284.86, down 3 percent from a year ago. January exports accounted for 12.2 percent of total beef production and 9.7 percent for muscle cuts only, down from 12.4 percent and 10.1 percent, respectively, in January 2018.

Results for both beef and pork were bolstered by stronger variety meat volumes. Beef variety meat exports totaled 26,630 in January, up 7 percent from a year ago, valued at $81.8 million (up 19 percent).

This was fueled by strong performances in Japan, the ASEAN region and Africa. Pork variety meat exports climbed 5 percent year-over-year to 41,143 mt, led by increases in Mexico, Japan, Central and South America and Taiwan. But value was still down 11 percent to $81 million, because exports to China, the leading market for US pork variety meat, remain subject to China’s 50 percent retaliatory duties.

Japan, Korea set strong early pace for 2019 beef exports

January beef exports to leading market Japan increased 8 percent year-over-year to 25,925 mt, valued at $167 million (up 12 percent). Variety meat exports to Japan (mainly tongues) were especially strong, soaring by 36 percent in both volume (4,645 mt) and value ($31.4 million). January was the first full month in which competitors of US beef received tariff relief in Japan under the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) with the import duty rate dropping from 38.5 to 27.5 percent on 30 December 2018. This gap will widen further on 1 April, when the rate for CPTPP countries drops to 26.6 percent.

"It’s great to see Japan’s demand for US beef increase in January despite these tariff rate changes for our major competitors," noted Dan Halstrom, USMEF president and CEO. "But this disadvantage will become more and more pronounced over time, so negotiations toward a US-Japan trade agreement cannot come soon enough. The playing field needs to be leveled as quickly as possible so that the US industry can continue to capitalize on booming meat demand in Japan."

Following a record-shattering year, beef exports to South Korea increased 4 percent in January to 17,900 mt, with value up 10 percent to $134.3 million. US beef enjoys a tariff rate advantage under the Korea-US Free Trade Agreement (KORUS), with the import duty rate declining from 40 to 18.7 percent since KORUS was implemented in 2012 (the rates for Australian and Canadian beef are 24 and 26.6 percent, respectively).

US beef is benefiting from several new trends in Korea, including mid-priced steak restaurants (also underway in Japan), inclusion of beef cuts such as chuckeye roll and short plate in meal kits sold at retail and through e-commerce, and demand for a wider range of US beef cuts, such as brisket point, in Korean barbecue establishments.

Other January highlights for US beef include:

- Export volume to Mexico was steady with last year at 21,194, but value climbed 14 percent to $101.7 million. The results for beef muscle cuts were especially strong, increasing 16 percent in volume (12,532 mt) and 21 percent in value ($78.2 million).

- Led by Indonesia and the Philippines, exports to the ASEAN region jumped 49 percent from a year ago in volume (4,644 mt) and 31 percent in value ($20.7 million). Variety meat exports more than doubled from a year ago to 1,941 mt (up 107 percent), with value up 85 percent to $3.8 million.

- Strong growth in Costa Rica, Guatemala and Honduras drove beef exports to Central America up 39 percent to 1,508 mt, while value was up 36 percent to $8 million.

- Exports to Taiwan were steady with last January at 4,215 mt, but value was down 12 percent to $36.8 million.

- A slow month in Hong Kong partially offset growth in other markets, as exports fell by 36 percent in volume to 7,047 mt, while value was down 28 percent to $57.4 million.

TheCattleSite News Desk