FAO Meat Market Review: Bovine market 2021

FAO shares insights about the meat market in 2021Editor's note: The following is a portion of the July 2022 FAO Meat Market Review publication summarizing the salient trends and drivers of meat market developments and significant public policy changes in 2021.

Global supplies tightened on lower output from leading exporters World bovine meat output in 2021 reached 72.5 million tonnes, up slightly (0.7 percent) from 2020, driven by output expansions in Asia, North America and Central American and the Caribbean, mostly offset by declines in South America, Oceania, Europe and Africa.

Concerning country-specific performance, bovine meat output increased in the United States, India, China, Uruguay, Türkiye and Canada. The output increase was driven by robust demand from Asia and higher carcass weight in the United States, while cattle stocks remained largely unchanged. In India, production expanded, reflecting the normalisation of the meat slaughter operations, as the Government ensured inter/intra-state movements of animals to slaughterhouses. Increased carcass weight and foreign demand also supported production expansion. In China, productivity gains in large-scale livestock operations led to bovine meat output growth. In Uruguay, production expanded reflecting the highest cattle slaughter increased slaughter reached in 16 years, induced by solid overseas demand, high FOB prices, increased cattle supplies, and positive return margins.

By contrast, output contracted in Brazil, Australia, Argentina, the United Kingdom, and the European Union underpinned by the limited availability of cattle for slaughter. Production in the United Kingdom fell from the highs in 2020 due to lower cattle stock, following increased liquidation in 2020. Labour shortages in meat processing also weighed on output contraction. In the European Union, the decline followed the falling dairy cattle numbers amid European Union-wide efforts to restructure the dairy sector, intending to improve efficiency and reduce the environmental footprint.

World total bovine meat trade in 2021 rose by 2.8 percent to 12.1 million tonnes, with much of the shipments originating in North America, Asia, Central America and the Caribbean, and those of Europe and Africa remained essentially unchanged but partially offset by contractions in Oceania and South America.

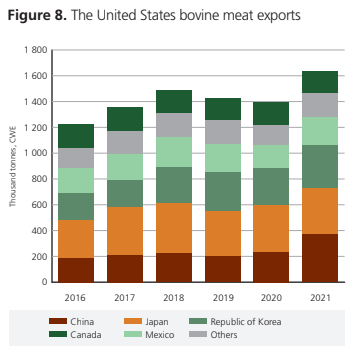

At the country level, the United States, Uruguay, India, Canada and Paraguay were among those countries that registered the most significant export expansions. The United States bovine meat exports rose by 17.5 percent, with five countries (China, Japan, the Republic of Korea, Mexico and Canada) accounting for nearly 90 percent of exports. Buoyed demand, benefitting from the tightened supplies from Brazil, Argentina and Australia, have driven exports from Uruguay and Paraguay to increase by 35 and 17 percent, respectively, in 2021. Lower internal demand, especially for better quality meat cuts amidst higher domestic prices, allowed Uruguay to export higher quality bovine meat products. Exports from Paraguay increased due to increased production, driven by a record high cattle slaughter induced by dry weather, repeated frost events that damaged pastures and corn production, and high cattle prices.

India’s bovine meat exports registered a recovery in 2021, helped by increased production and higher demand from Egypt, Malaysia, and some Middle Eastern markets. Besides, high market diversification helped India withstand lower demand from North-East Asia. Canada’s bovine meat exports to the United States continued to expand, with boneless, fresh or chilled making the bulk of exports. Tight export availabilities underpinned export contractions in Brazil, Australia and Argentina. The decline in Argentina was due to bovine meat export restrictions, starting from an export ban in May, which was later relaxed but continued to apply for select beef cuts.

Bovine meat imports continued to expand in China, while others, including Chile, Egypt, Indonesia, the Philippines and the Republic of Korea, registered partial recovery from depressed imports in 2020. By contrast, several countries curtailed bovine meat imports, especially the Russian Federation, Canada, the European Union, Japan and the United Kingdom.

To read the full report, click here.

Reference: FAO. 2022. Meat Market Review 2021. Rome.