Rabobank releases 2025 BBQ Index: Will a trade war burn the summer BBQ?

Grilling season has arrived. Rabobank analysts dig into pricing of our favorite BBQ essentialsRabobank, a premier global food and agribusiness bank founded 125 years ago and a leading financier of the energy transition, today released the annual BBQ Index ahead of grilling season. Rabobank’s analyst findings outline that the cherished summer ritual might be a welcome respite from tariffs and trade wars—prices are up, but mostly domestic supply chains mean mostly domestic reasons for those increases.

Rationale and methodology

The Rabobank BBQ Index assumes an average American BBQ situation—a mix of family and friends—ahead of summer grilling season. That includes 10 adults with each consuming the same amount of food and beverages. We assume each person will consume one cheeseburger with lettuce and tomato, one chicken sandwich with lettuce, tomato and a slice of cheese, two handfuls of chips, two beers, a soda and a few scoops of ice cream. As a means of comparison, the BBQ Index parallels the Bureau of Labor Statistics as a data source. We selected the monthly data series "average price index, US city average."

“On the whole, Americans still spend less of our wallet on food than our counterparts in most other nations, but that gap is closing across the board,” said Tom Bailey, Senior Consumer Foods Analyst, Rabobank.

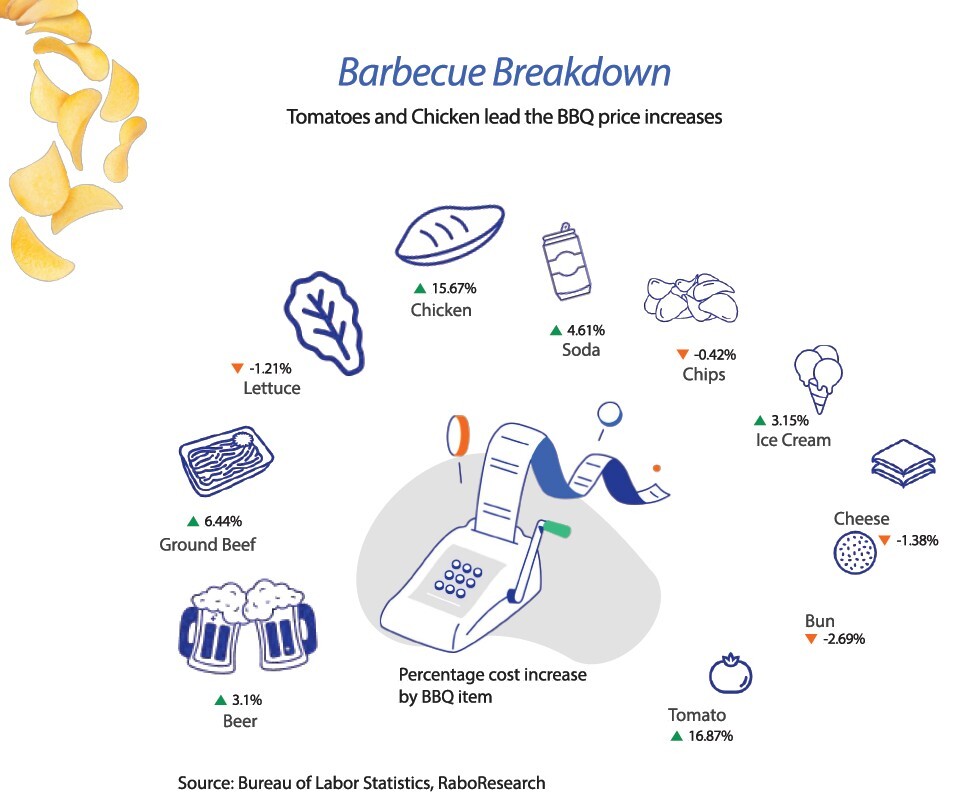

For 2025 the BBQ Index highlights a 10-person BBQ is more expensive this year than last, 4.21 percent more expensive to be exact.

Prices have risen for many ingredients found in a traditional summer BBQ. However, despite the increase, the essential items for summertime grilling have not been hit as hard by inflation as some other consumer goods. For instance, eggs, although a small component of the overall food basket used to determine the Consumer Price Index, have only recently begun to decrease in price after experiencing significant year-over-year price spikes. A strong domestic supply chain for many of the items on the table means that the price increases are due to other factors besides trade uncertainty.

Beef is beefing up

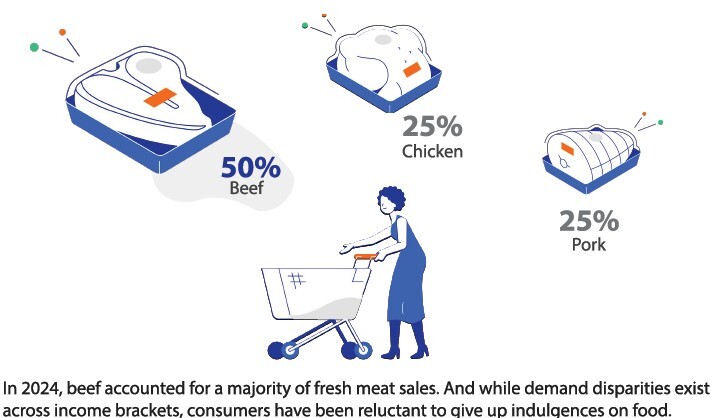

Senior Beef Analyst for Rabobank, Lance Zimmerman stated, “Beef supply, especially the fresh product Americans like to grill, is mostly domestic. Prices are up, but the reasons include a continued strong demand for beef despite economic concerns coupled with a years-long downward trend in supply.”

The beef cowherd size has been decreasing since 2019, leading to supply constraints. However, consumers have maintained their beef purchases despite economic difficulties, resulting in higher prices due to the combination of limited supply and robust demand.

Cheese please!

American consumers’ love of cheese both natural and processed has shown no signs of slowing. We ate 8.5 pounds of processed cheese in 2023 (the most since 1999) and hit an all-time record of 40.5 pounds of natural cheese per person. Prices for processed cheese spiked in June of 2024 and then fell back off, so there’s a chance the American cheese single on your burger this summer might not cost any more than its predecessor at last year’s BBQ.

Beer – the most American beverage?

“Between relatively local supply chains and the ability of some multinational breweries to shift production of different brands from one location to another, beer prices for the BBQ will be less likely to be affected by tariffs, outside of some true imports,” said Jim Watson, Beverage Analyst, Rabobank.

The beer supply chain typically operates on a local level, allowing major brewers to shift production of their 'imported' brands to US breweries in response to tariff changes. Over the years, the beer market has seen a trend towards 'premiumization,' favoring upscale brands over budget-friendly options, resulting in price hikes that have outpaced wines and spirits. Currently, consumer preferences are shifting towards hard seltzers and ready-to-drink cocktails, potentially leading brewers to grapple with an oversupply of inventory akin to challenges experienced by the competing wine and spirit producers.

The takeaway

Prices for the backyard BBQ in 2025 are on the rise, driven by supply and demand dynamics and inflation rather than tariffs. The all-American summer BBQ experience is closely tied to an all-American supply chain, shielding backyard chefs from the uncertainties of trade wars. Digest more of the Rabobank 2025 BBQ Index featuring dairy, poultry, baking and produce here.