Outlook for Biofuels is Solid, Less So for Grain and Farm Supply

CoBank analyst shares industry driversA year ago CoBank signaled that the grain, farm supply, and biofuel sectors would face a mixed outlook from a combination of escalating costs, supply chain bottlenecks, and high energy prices. But 2022 proved even more tumultuous than expected given Russia’s invasion into Ukraine, multi-decade high inflation in the United States and Europe, and the steep economic slowdown in China.

Interestingly, U.S. diversified ag cooperatives generally delivered above-average results driven by agronomy related sales and services, even in the wake of fertilizer and chemical supply chain disruptions. In the meantime, ethanol producers defended margins (even with slowing gasoline demand) through prudent commodity risk management and operational efficiencies. Looking forward to 2023, we see an environment of margin pressure amidst a slowing economy, rising interest rates, high labor and energy costs (namely diesel fuel), and trade uncertainty with China and Mexico. Ongoing drought and volatile weather remain additional risk factors for crop production. Animal feed demand is softening, reflecting flat overall growth in the domestic livestock sector.

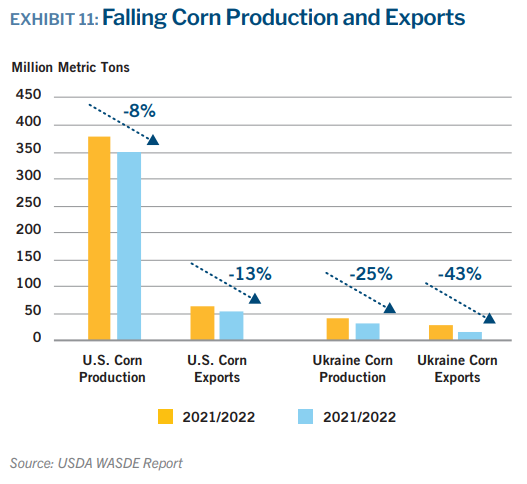

Grain elevators and merchandisers face a mixed picture for the year ahead. On the negative side, grain exports were stunted in Q4 2022 by transportation bottlenecks on the Mississippi River and reduced purchases of soybeans and corn by China, both of which could result in missed opportunities for the current marketing year. And then there is the Mexico situation: The country’s president decreed that Mexico would ban the importation of genetically modified corn in 2024, which would have jeopardized roughly one quarter of all U.S. corn exports. The Mexican Secretary of Economy recently suggested the ban will be pushed back to 2025 and it now appears that U.S. corn exports to Mexico will continue unabated for the next two calendar years. We continue to believe that the GMO corn debate is a bargaining tactic in Mexico’s quest to improve Mexico/U.S. energy trade policies.

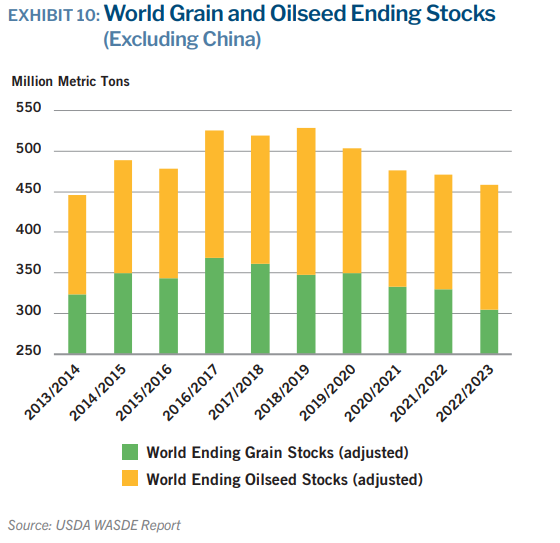

On the positive side for U.S. producers, Ukrainian grain and oilseed production and exports are likely to remain constrained for the next few years due to the Russia conflict. This will provide underlying support for grain prices, and aid U.S. corn exports. Finally, combined global ending stocks for grain and oilseeds are still very tight after falling for four straight years to their lowest level since 2013/2014. It will take at least a couple of years to build stocks to a more comfortable level.

Ag retailers begin 2023 on strong financial footing but face several challenges. Labor shortages and rising wages will negatively impact margins. In addition, wholesale fertilizer acquisition costs will remain high during the first half of 2023 as cooperatives not only absorb high barge and rail costs but also compete with export markets for limited supply. Some 70% of European fertilizer production was offline during Q3 2022 as the region dealt with record-high natural gas (feedstock) prices.

Fertilizer prices will likely begin and end 2023 at elevated levels, minimizing the opportunity for retailers to capture the same level of carry margin that was available during 2021/22. The outlook for biofuels is very strong, supported by federal policy and demand tailwinds from 2022. Ethanol will benefit from greater usage of E15, growing demand for corn oil, and strong pricing of carbon dioxide. Carbon dioxide, a co-product from fuel ethanol production, is experiencing a demand surge from both industrial users (food and beverage companies) and carbon sequestration projects. The momentum behind renewable diesel will continue to grow as new soy crush processing and oil refinement facilities come on line, supported by the Inflation Reduction Act of 2022.

This article, written by Kenneth Scott Zuckerberg, is part of a series of 2023 outlook articles from CoBank. Read more by clicking here.