Cost considerations for replacements

High replacement prices can add hundreds of dollars per weaned calf before feed and labor are counted

Improvements in production efficiency have enabled the beef industry to produce more beef with fewer cows. The reduction in the number of beef cows in the US has been occurring since the 1970s. Increased fed cattle harvest weights are part of the efficiency story. To date, consumer demand for beef has remained strong, and market prices for all classes of cattle have reached record highs. So, what considerations should producers have as they contemplate ownership options for beef cows and replacements in this market? How many heifer calves should they keep as replacements, or what can they afford to pay if they are purchasing replacements?

When the market signals an expansion in the cow herd, it takes time for more fed cattle to reach harvest due to the long biological cycle of the cow. This creates a cyclical pattern in cow numbers known as the cattle cycle. In general, this has meant that heifers retained at low inventory levels will reach their peak production when fed cattle supplies have increased, and market values decrease. Cattle cycles have changed over time and are flatter than earlier cycles. An updated evaluation of the US cattle cycle is available on Agmanager.info.

If the business horizon is relatively short and forage supply for the operation is generally fixed (i.e., there is no desire or opportunity to add forage acres in the next few years), then retaining more heifers is less likely to make sense or occur. If the planning horizon is longer, and the forage outlook is good or purchasing more land is an option, retaining more heifers may make sense.

Either way, it is important to understand how current prices add to total production costs. Cow depreciation is not a bill you explicitly pay out-of-pocket, but it does impact your bottom line. Aspects of the One Big Beautiful Bill provide new options for depreciation that you should consider with your tax accountant.

Let’s consider the example of a female with a cost of $4250 as a 2-yr old, bred replacement heifer and a value of $2000 when she leaves your herd (insert your own values). If this female stays in the herd for 4 years, her annual depreciation cost would be $563 (4250-2000/4=562.5) or $450 if she stays 5 years. With a 1.5% death loss on a $3125 average cow value, that adds another $47 per cow per year.

Regardless of whether replacements are raised or purchased, those dollars have an opportunity cost, meaning they could be invested elsewhere. Using our average cow value of $3125 and an interest rate of 8%, the annual opportunity cost would be $250. Consider further that of 100 cows exposed to breeding, only 90% have a calf to sell at weaning, the total depreciation and opportunity cost would be $830 per weaned calf.

While the market will set a value for bred replacements, the real question should be how much can you afford to pay, or whether or not to look at their value. The KSU Beef Replacements spreadsheet on Agmanager.info can help determine the economic value of purchasing replacement females.

A primary input for the tool is your own production costs. The KSU Beef Replacement tool allows you to see the impact of a range of annual costs of production. Data compiled by the Livestock Marketing Information Center (website at LMIC.info) estimates annual total cash cost plus pasture rent for 2024 through 2027 to be $1070, $1120, $1105, and $1073, respectively. All else being equal, someone with lower costs of production can spend relatively more on a replacement and have the same net return on the investment as someone with higher costs of production.

You can also explore the impact of different feeder calf and cull cow sale price projections and calf performance (weaning weight) expectations. For example, if replacements are pregnant 2-year-olds, calf weaning weights would be expected to be lower for her first calf than the 4th or 5th, or if you consider mature cows as your replacements, the weaning weight over time might be more consistent during her productive life. Three different calf and cull price scenarios are presented: current USDA projections, $40 under, or 10% over USDA price projections. You can input your own values.

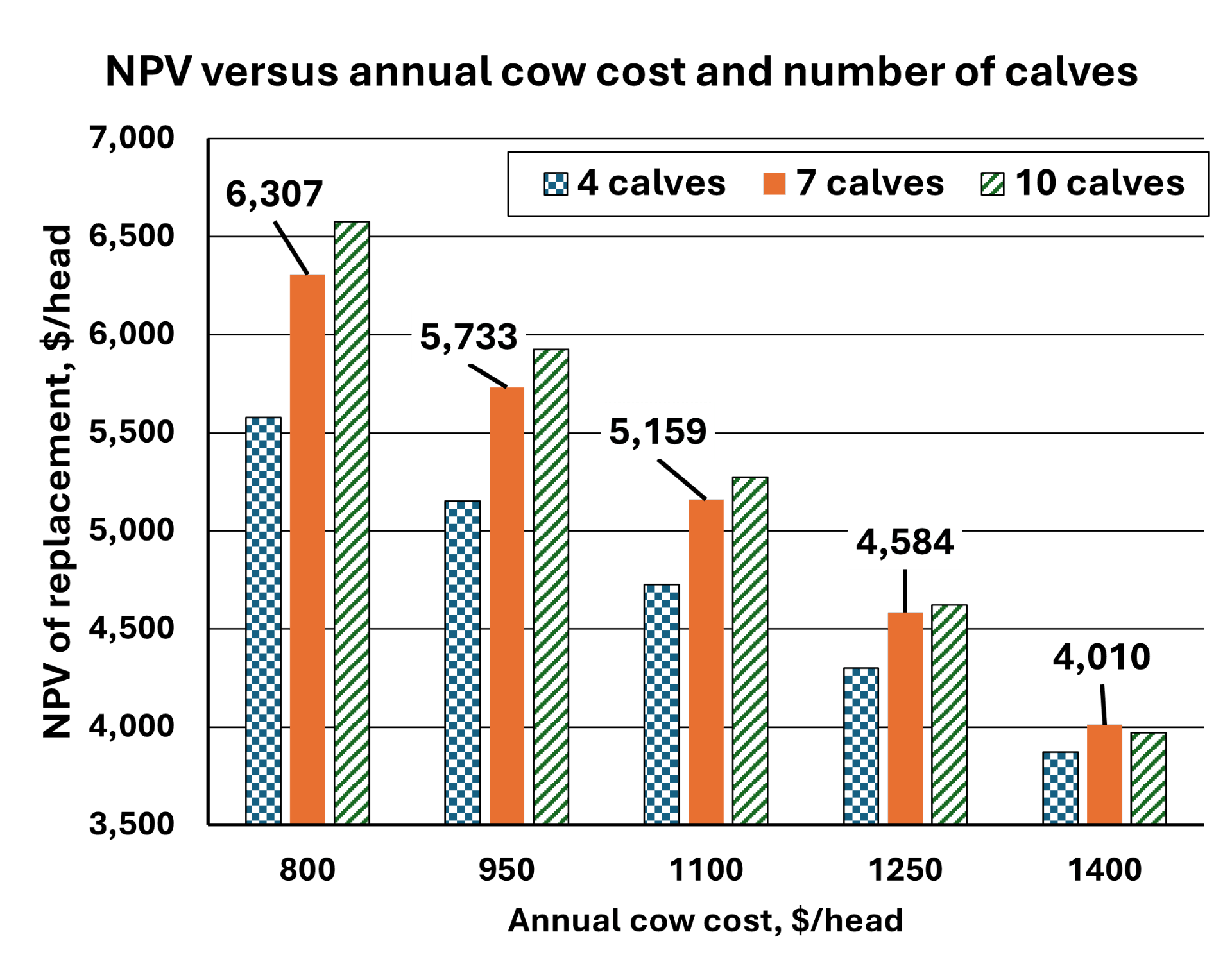

The key output of this spreadsheet is the Net Present Value (NPV) of females based on how many calves they might produce. The Net Present Value reflects the amount that could be paid for a replacement such that the expected rate of return from the investment would be exactly equal to the discount (interest) rate given all the assumptions used in the analysis. The target rate of return is a user input. Another way to think about Net Present Value is to consider it as a benchmark price level, so if you can either buy or develop your replacements at a price cheaper than the estimated Net Present Value, then that is a better economic situation for that group of females. Likewise, this tool demonstrates the importance of knowing your production costs, and calf performance and death loss levels because those factors substantially impact the price we could/should pay for replacements.

The output in this graph represents the NPV in dollars per head for different production scenarios. Calf prices were USDA projections for December 2025, including 97% marketable calves, a 15% annual cull rate, 3% inflation on costs and an 8% interest rate.