Will the US Continue Selling Beef to Taiwan?

US government officials expect beef sales to Taiwan to remain steady despite the imposition of new beef quality checks and residue limits.In September 2012, Taiwan authorities implemented a maximum residue limit (MRL) for ractopamine in beef, expanding market access for U.S. products. Since then, U.S. beef exports to Taiwan have recovered well and currently on pace to exceed the 2010 record year. Still, high prices and increasingly limited supplies may constrain exports.

History

U.S. beef exports to Taiwan were impacted when in January 2011 Taiwan's Food and Drug Administration (TFDA) began inspecting, testing and rejecting shipments of U.S. beef due to ractopamine residue detections. Ractopamine is a beta-agonist approved in the United States and many other countries where it is commonly used as a lean meat enhancer in cattle and hogs.

Taiwan's domestic hog producers - though limited in number have significant political sway - see the use of betaagonists in U.S. hogs as a threat to their own livelihood. Local hog producers have staged protests against market access for U.S. pork (thereby beef) based on supposed beta-agonist concerns.

On July 5, 2012, CODEX Alimentarius Commission established an MRL for ractopamine in beef and pork. As a result, TFDA also implemented the recommend 10 ppb MRL for ractopamine in beef, effectively allowing for expansion of U.S. beef imports. The new regulation came into effect on October 1, 2012.

Trade Impact

Following the implementation of batch-by-batch inspection of U.S. beef in March 2012, purchases slumped precipitously as exports were effectively limited to natural or organic product. In February 2012, the United States exported 2,825 MT of beef to Taiwan, but by April trade was down over 90 per cent to only 216MT.

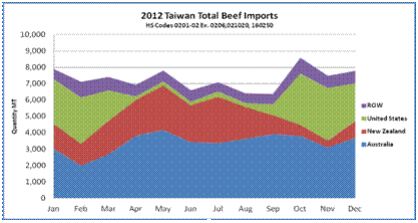

During the first three-quarters of 2012, Taiwan's purchases of U.S. beef shrank by 12,000 MT compared to the previous year, a decrease of 56 per cent . Not incidentally, this contraction was effectively parallel with the decline of total beef imported into Taiwan during that period.

Thus, while Australia and, to a lesser degree, New Zealand saw an increase in their beef exports to the island, the majority of the market share previously held by the United States was not claimed by competitors.

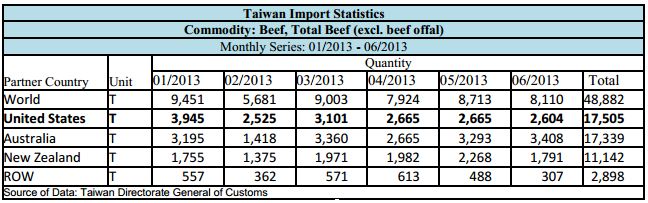

Fall is typically a slow season for the Taiwan retail and foodservice industries as shoppers look to save for back-to-school supplies and tuition. Thus consumer beef demand was not expected to be particularly robust in the 4th quarter of 2012. The trade numbers soon revealed otherwise, however, and U.S. beef exports to Taiwan in October 2012 rebounded 367 per cent over September with November numbers even higher. This trend has continued through the first half of 2013 as the United States has reclaimed its position as the number one supplier of beef to the island, both by value and volume.

Consumer Reaction - or Lack Thereof

The Taiwan media was fervent in covering all aspects of the ractopamine issue, however, the often harsh coverage rarely revealed negative consumer sentiment. In Taiwan, consumer confidence in the U.S. food safety system did not seem to waiver. Consumers may be immune, numb, or otherwise disbelieving of the daily politics and media hype. Many foodservice operators indicate that consumers simply prefer U.S. beef.

Retail

Prior to January 2011, Costco was the largest fresh beef importer in Taiwan. Costco's fresh chilled beef import volume accounted for over a quarter of total U.S. chilled beef exports to Taiwan.

These hypermarkets are increasingly popular on the island and Costco recently celebrated the opening of its tenth Taiwan branch. Before the initial U.S. BSE case in 2003, Costco supplied exclusively U.S. beef.

However, since 2003, Australia beef claimed varying market share. Only in June 2013 did Costco's popular Taipei outlet revive their "100 per cent U.S. Beef" policy. Local beef importers estimate the retail store will continue to bring in 4,000 to 5,000 metric tons of beef annually.

Moreover, in response to the ractopamine MRL establishment, Taiwan authorities implemented a mandatory country of origin labeling regulation exclusively for beef and beef products. Domestic and imported product sold at restaurants, retail stores and wet markets is required to bear labels detailing the country of origin. The new labeling requirements also extended to packaged food containing beef such as beef noodles and beef jerky. The sustained popularity of U.S. beef, however, indicates that the new labeling requirement has little negative impact.

Foodservice

With more than 60 per cent of U.S. beef exports to Taiwan sold through foodservice channels, restaurateurs' faith in U.S. beef safety was a crucial focus of U.S. beef market development and outreach efforts. Over the past year, approximately 60-70 per cent of single and small operation restaurants - which have more flexibility to quickly change menu items - reintroduced U.S. beef to their menus. U.S. beef has also reclaimed its "top billing" at Taiwan's highest-end restaurants. Larger foodservice franchisers and retail chains had more Australian or New Zealand beef in stock and hence restored U.S. beef at a slower pace compared to smaller operations.

International Supply and Demand Constrain Grown Potential

Taiwan is a dynamic and mature market for food and agricultural trade. Among all the major export markets for U.S. beef (excluding Canada), Taiwan pays the highest unit value for U.S. beef products and, thus, generate high margins for U.S. exporters. This also indicates that Taiwan consumers are willing to allocate a relatively high percentage of their living expenses on high quality gourmet food.

It is estimated that 2013 U.S. beef exports to Taiwan will rebound to near 2010 record levels. However, there are some external forces that may hamper U.S. beef exports from reaching their full potential in the Taiwan market.

Rising production costs and tighter supplies: the U.S. meat industry is facing exceptional challenges resulting from extreme drought conditions in the U.S. during 2012. Imperfect weather conditions combined with more corn diverted to ethanol production results in high feed costs. Increased input costs resulted in many U.S. beef producers to reduce their heard size.

Beef herds in the United States are currently at 60 year lows. The result is increased retail prices for U.S. beef, both domestically and abroad. Quotes for some beef cuts are 10-30 per cent higher than before January 2011.

Regional competition for popular cuts: Certain beef cuts historically popular in Taiwan (e.g. chuck eye roll, heel muscle, rib fingers, chuck flap, top blade muscle and chuck short ribs) are increasingly sought-after in neighboring countries. Taiwan importers must now outbid Japanese, Vietnamese and South Korean importers for the already limited U.S. beef supplies. Ironically, many packers used Taiwan as a test market for new products due to Taiwan's market maturity, relatively high per-capita GDP and food-oriented culture. However, success in the Taiwan market sees U.S. suppliers shift attention to other regional markets.

Slow economic growth: Being heavily reliant on exports, Taiwan's economy has yet to recover from the 2008 economic collapse. So far, in 2013, the economy is growing at a slightly slower pace than 2012 and many Taiwan consumers are not optimistic for a speedy recovery. Thus, spending on gourmet food products, such as U.S. beef, has likely been restrained.

Conclusion

This office anticipates that U.S. beef will continue to sell well in the Taiwan market with barriers to trade being strictly economic (i.e. high prices) as opposed to any new political or sanitary issues. Taiwan authorities readily admit wanting to avoid a repeat of the ractopamine debacle which clearly harmed to the United States/Taiwan relationship.

Consumers continue to prefer U.S. beef and are willing to pay a premium for what they perceive as a superior product. Still, beef is an elastic good and continued high prices will impact demand throughout the distribution channels.