Review of the Polish Beef Sector

After Ireland, Poland is the second largest net exporter of beef in the EU-27. The Polish beef industry was transformed after their accession to the EU in 2004. Up until this point, around 60 per cent of exports were in live form, writes Peter Duggan from Bord-Bia, the Irish Food Board.Industry characteristics

The Polish beef industry is dependent on the local dairy industry with around 90 dairy ofthe country’s 547,000 livestock producers having a dairy enterprise. The average Polish farm size stands at eight hectares.

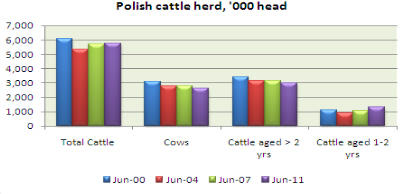

The herd is showing modest growth, rising by almost one per cent to 5.76 million head in 2011, reflecting some growth in cow numbers over recent years combined with the on-going slowdown in live exports.

However, when compared to levels during 2000, this represents a fall of over five per cent. During the same period, the number of dairy cows fell by 18 per cent to 2.5 million head. While off a very low base, the number of suckler cows rose by 83 per cent to 153,000 head.

Net beef production

Beef output was almost two lower in 2011 at 380,000 tonnes. In comparison to 2003 levels though, this represents an increase of 18 per cent in output.

Beef Exports

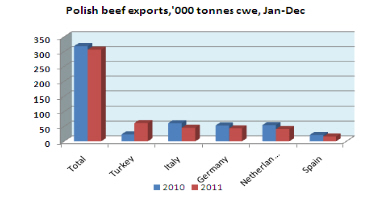

The value of Polish beef exports, including live cattle, are estimated to have increased by 30 per cent to over €1 billion in 2011, reflecting a combination of stronger demand for beef across international markets and a weaker Polish Zloty.

However, the volume of exports fell by four per cent to 308,000 tonnes. This compares to exports of 75,000 tonnes when they joined the EU in 2004. Around three quarters of the value in exports are in chilled form, and around three quarters are exported in bone-in form.The strongest market in 2011 was Turkey, which imported around 62,000 tonnes of Polish beef. Lower volumes were exported to traditional customers like Italy, Germany, the Netherlands and Spain.

In terms of live cattle, exports were forecast to fall by 13 per cent to 179,300 head in 2011. This compares to live exports of 307,800 head in 2007.

Processing Sector

The Polish beef processing sector is underpinned by a large number of small processors that have relatively low capacity levels and a small number of processors that are running highly scaled and efficient plants. At the moment there are 2,500 beef/pork slaughter houses in Poland.

National weekly throughput is estimated at just over 20,000 head. The top six processors control around 80 per cent of national throughput. The top six processors ranked in terms of throughput are Sokolow (owned by Danish Crown), Zakrzewscy, Biernacki, Animex (owned by Smithfield), ABP Food Group and Lukow (East of Warsaw).

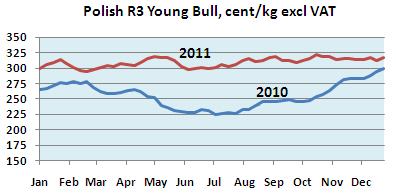

Cattle Prices

Similar to many other European countries, producer prices for finished cattle increased strongly in 2011, with R3 young bull prices rising by around 21 per cent to average €3.09/kg. This was around 12 per cent below the EU average. The gap between Polish and EU prices has been closing over recent years, with prices as recently as 2008 running about 30 per cent below the EU average.

Polish beef output is unlikely to show any significant change over the short term, as cow numbers remain broadly stable. However, given the recent boost to producer confidence from the increase in farmgate prices, combined with the prospect of more favourable payments under the upcoming reform of the CAP, the indications are that Poland has the capacity to recover to pre EU accession levels.

Since Poland is the second largest net beef exporter within the EU after Ireland, any significant change in exports to international markets is likely to create a further deficit in the European market. This was the scenario that unfolded in late 2010 as Turkish authorities lowered tariffs from 225 per cent to 30 per cent.