Effects Of Southern Plains Drought On Cattle Industry

The southern plains states have been stricken with a severe drought and the liquidation of cattle out of Texas, Oklahoma and other dry southern states has made some extra ordinary impacts on the cattle markets, writes Shane Ellis, Department of Economics, Iowa.Lack of forage in parched pastures and rangeland has sent many early wean, light weight calves to confined feeding more than months sooner and over a hundred pounds lighter than usual. This change in cattle placement timing will, in turn, shift the traditional finished cattle marketing timeframe forward.

July feeder cattle placements in feedlots were the largest on record, with a similar story for August placements. These lighter calves will likely have a lower body weight when they reach a finished body condition. In short there will be more market cattle available earlier and at lighter weight in the spring of 2012.

Keep in mind that this supply of fed cattle is coming from the 2010 and 2011 total calf crops which were both down about a percent from the five year average. Beef calf supplies by themselves were down in those two years. So a significant portion of the seasonal supply of fed cattle will be rolled ahead of the traditional marketing volume pattern, and a smaller than usual supply of cattle will be available during the busiest marketing period.

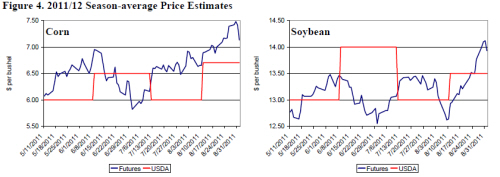

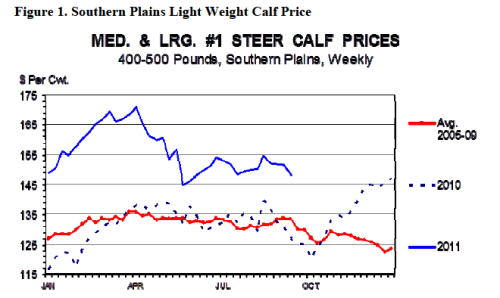

Figure 1 tracks the light calf price in the southern plains and Figure 2 illustrates the earlier than usual placement of calves in the nations feedlots. While the summer calf prices are well above those of a year ago, the decline in calf price is obvious when the additional supply of drought-displaced calves came to market.

Feeder cattle out sold from the drought areas are going into Texas, Oklahoma and Kansas feedlots with even a few appearing in the Iowa feedlots. It is hard to ignore a feeder cattle market with robust supplies and dampened prices even if those cattle are smaller and lighter than usual.

Conditioning these cattle to the Iowa feedstuff and environment can be its own challenge, and can be a potentially educational moment for the producer. Yet another dynamic is the breeding of southern plains calves compared to that of cattle raised in the upper plains states. Cattle bred for the warmer conditions of Texas and the Deep South are may not fare as well in the severe winter conditions of Iowa and Nebraska or even Kansas.

So that is the here and now, but looking out in to the future, what will happen in the next year or when the climate conditions return to normal in the southern plains? It has been estimated that Texas will be moving out about one million producing beef cows this year. Roughly half of those beef cows will remain in production and added to the herds in areas where feed is available.

The other half are or have been adding to an already record high beef cow slaughter number. Fortunately the demand for ground beef product is still strong and packers are more than willing to process these cows. A year from now the beef cow herd could be down more than three per cent smaller and if the drought subsides there were even fewer cull cows available for slaughter.

Additionally, if forage conditions in the Southern Plains improve there will new demand for replacement breeding stock to restock the diminished cow herds. This would provide additional bullish pressure on the trimmed and ground beef prices. It will also be an opportunity for breeding stock producers to provide new young replacement animals, although the rebuilding of the Southern plains cow herd will take several years even with good forage conditions.

Longer term the national inventory of breeding beef cows is still expected to increase by the beginning of 2015. Effects of the drought have accelerated declining trend in cow inventories, which could lead to a more abrupt turn in the cattle cycle. But what it does not change is the fact that there will be a declining supply of feeder and fed cattle for the next three years or more.

Economic Conditions and the Cattle Markets

Market volatility has been common place in the markets for the last several years. September is proving to be a month of bearish volatility for many markets including cattle. Futures prices have been declining for both live cattle and corn.

Keep in mind that the cattle market is still very sensitive to the economic conditions and outlook of the US and to a degree the globe. Corn prices of course are heavily influenced by the energy market which is also sensitivity to the economy. Commodity and stock investors have been sending the signal as of late, that they are not so confident in the nation’s ability to keep itself from returning to a recession.

For cattle finishers this is a “catch 22” as corn prices are declining despite tight supplies and fed cattle prices are also softening on uncertain demand. Examine your marketing strategies and choose the best plan for you, but be aware of the emerging and dissipating opportunities.

The Softening of Demand

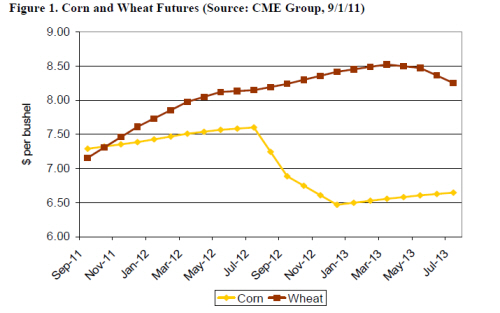

Throughout August concerns about crop supplies drove the markets higher. USDA lowered its yield estimates significantly for both corn and soybeans. The 5.7 bushel drop for corn and the two bushel decrease for soybeans are being backed up by private estimates of lower crop yields.

A second round of yield cuts for corn in the September report put national corn yields over four bushels below last year’s average. Weather continues to stress the crops and lower yield expectations. Projected supplies have shrunk to levels such that ending stocks are expected to be at pipeline levels, putting pressure on prices and demand. Given the prices in the market today, it is not surprising that demand is weakening. Corn and soybean users are working through higher costs during a limited economic recovery. Concerns about a second economic downturn hang over the crop markets.

When USDA updated its yield and supply estimates, it also provided updates on demand. Those updates showed demand dwindling in the face of higher prices. For corn, over the last two months, feed demand estimates were lowered 350 million bushels. Ethanol demand was reduced by 150 million bushels and export demand was lowered 250 million bushels. For soybeans, domestic crush demand was reduced 20 million bushels and export demand dropped 80 million bushels. These shifts in demand are being driven by other factors, besides the higher corn and soybean prices.

Feed demand is being influenced by meat demand, feed costs, and alternative feed sources. Customer demand for meat took a sizable hit during the recession and that demand has not fully recovered. Higher prices for livestock and meat have limited that recovery. But despite those higher prices, returns to the livestock industry have been hit or miss over the last few months.

Expansion in the industry looks to be some distance off in the future. As livestock producers look to reduce costs, they are exploring alternative feed rations. That exploration involves possibly replacing corn and soybean meal in livestock rations with other feed ingredients.

One alternative is feeding wheat. While corn is the major feed grain in the US, wheat is a widely used feed grain worldwide. Given the lack of a significant price spread between corn and wheat, livestock feeders, especially in the Southeast, have found wheat to be a favorable alternative to corn this summer and fall.

While the wheat harvest in the Southern Plains was significantly smaller due to the drought in Texas, Oklahoma, and Kansas, wheat yields in the Southeast were at record levels. With plenty of wheat in the region, livestock producers have evaluated their rations and moved to incorporate more wheat in livestock diets.

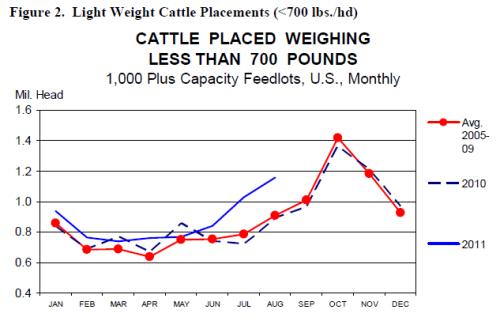

As Figure 1 shows, nearby wheat futures are actually below corn. Normally, wheat commands a healthy premium to corn. Current futures do not display that premium until we look out to 2013. So, in the short term, feed demand is shifting from corn to wheat.

Another factor in the feed sector is the continued expansion of the ethanol industry. For every bushel of corn that enters an ethanol plant, roughly 17 pounds of distillers grains are produced along with the ethanol. These distillers grains are being utilised by livestock feeders throughout the US, partially offsetting corn and soybean meal in rations.

Over the last couple of years, distillers grains production has grown to 35-40 million metric tons with domestic usage reaching about 30 million metric tons.

The feed discussion can also be applied to the export picture as the vast majority of our corn exports and a sizable portion of our soybean exports are targeted for livestock feed. For the 2010 crop year, corn exports received a big boost from Egypt as they replaced lost feed wheat from Russia (due to a drought) with US corn.

With the rebound in Russian wheat production this year, Egypt has once again shifted back to wheat to fill most of its feed needs. The increase in distillers grains production has also influenced international feeding. The US now exports nearly nine million metric tons of distillers grains. Roughly one-third of that is shipped to Canada and Mexico, and a growing percentage is headed in eastern Asia. China, South Korea, and Viet Nam are significant purchasers of distillers grains.

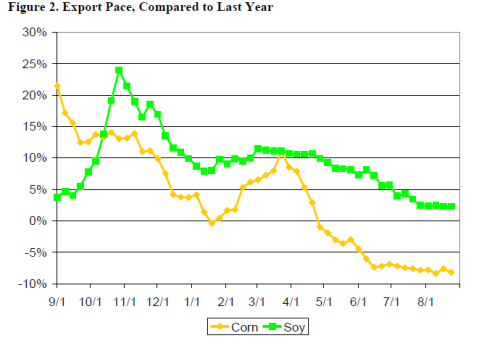

Figure 2 shows our corn and soybean export pace over the past year, in comparison to the year before. As you can see, last fall exports were off to a solid start. Corn exports started the marketing year 20 per cent above the previous year’s pace.

Soybean exports were up five per cent. And while soybean exports continued to surge into the winter, corn started to lose ground. Throughout calendar year 2011, both crops have seen export demand back off, especially this summer.

China’s demand for soybeans has slowed. Japanese buying patterns have shifted with the triple disaster (earthquake, tsunami, and nuclear breakdown) with increased meat imports and reduced corn imports. Another factor for corn is the expectation of increased corn production in many parts of the world. Current projections show better corn crops in Argentina, Brazil, Mexico, Russia, Ukraine, South Africa, China, and the European Union.

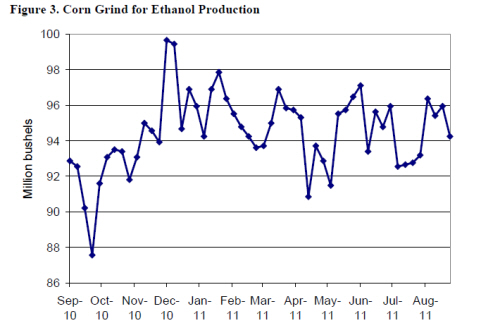

Corn demand through ethanol has provided the largest surge over the past five years, but that surge is definitely slowing down. As the industry has matured and the number of new plants coming online has slowed, the need for increasing amounts of corn has also declined.

Figure 3 shows the weekly corn grind for ethanol over the past year. There is no longer an upward trend to the grind. Since the beginning of the calendar year, we have used roughly 95 million bushels each week to produce ethanol. So while ethanol remains a solid, consistent source of corn demand, it is not adding to its demand pull as it has in the past.

Throughout August the markets have concentrated on lower yield and supply estimates. But demand is slipping as well. Based on current estimates, corn demand will fall 2.5 per cent and soybean demand will fall 3.4 per cent in the 2011/12 marketing year.

Higher corn and soybean prices have put the squeeze on buyers, especially as the markets have factored smaller crops than USDA has projected. With the futures markets providing prices that translate into 2011/12 season-average prices between $7 and $7.50 per bushel for corn and around $14 per bushel for soybeans, crop margins continue to look good for this harvest season. But those record prices are wearing down demand and forcing purchasers to explore alternatives to keep costs down.