The Value Of The Red Meat Industry To Australia

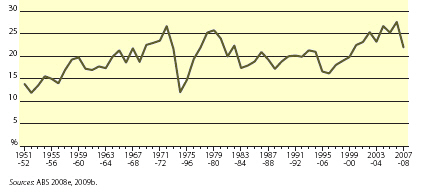

Red meat production and live exports of sheep and cattle accounted for nearly 22 per cent of the total gross value of Australian agricultural production in 2007-08, according to a new report from ABARE for for the Australian Government Department of Agriculture, Fisheries and Forestry.Although it is variable, the trend over time suggests an increasing contribution of sheep and cattle toward the total value of agricultural production, particularly over the past 10 years.

The red meat industry (including live exports) also accounts for a significant proportion of the value of agricultural exports, contributing 22 per cent to the value of Australian farm exports in 2007-08.

The red meat processing industry is an important market for products from other sectors, including live animals, transport services, the container industry and the detergent industry. In addition to meat products, the red meat industry also produces by-products including hides, skins, oils and fats, that are used as inputs into other industries. As a result, growth of the red meat industry contributes to growth in other economic activities.

The report says that the economic importance of the red meat industry is more significant at the regional level where farming, particularly livestock production, comprises a large proportion of total economic activity. To illustrate this, production activities within the red meat industry were identified and a region for each was selected. The economic importance of the red meat industry for each of these regions is discussed in more detail in the report.

Factors Affecting the Industry

Drought can influence feed prices, slaughter rates, the demand for sheep and cattle for restocking, and saleyard prices. Poor seasonal conditions generally lead to a reduction in pasture availability, an increase in feed costs and higher slaughterings, and a decline in herd and flock numbers.

Domestic demand for red meat is another factor that can affect the industry. In Australia, there has been an increase in the demand for poultry and pig meat as they are substituted for red meat, partly reflecting changes in relative prices.

Foreign meat demand continues to be important for the industry. Although Australia’s major markets, particularly for beef, are mainly in developed countries, developing country markets are becoming more important as incomes and populations in these markets increase.

Exchange rate fluctuations influence the red meat sector because a large proportion of Australia’s red meat is exported. A stronger Australian dollar translates into relatively more expensive Australian exports in other countries, reducing the quantity of Australian meat demanded in those markets.

In the global market there are barriers to trade in beef and sheep meat that affect Australia’s red meat industry. Such barriers, for example, include country specific EU import quotas on sheep meat and beef, and the Japanese tariff on imported beef.

Red Meat Industry in Australia

Australia is among the world’s largest producers of red meat, with 2.15 million tonnes (carcase weight) of beef and veal, 435 000 tonnes of lamb and 258 000 tonnes of mutton produced in 2007-08. In 2007-08, the gross value of beef and veal produced was more than $7.4 billion, and for sheep meat it was around $2.2 billion.

Australia is the world’s second largest exporter of beef and sheep meat. In 2007-08, around 64 per cent of beef produced in Australia was exported, 45 per cent of lamb and 82 per cent of mutton. The combined value of beef, lamb and mutton exports in 2007-08 was slightly more than $5.4 billion.

Australia is also a large exporter of live animals, particularly out of northern and western Australia. In 2007-08, more than 700 000 cattle, valued at around $450 million, were exported mainly to markets in South-East Asia. More than 4 million sheep were also exported in 2007-08, mostly to the Middle East, with a value of around $280 million.

The distribution of cattle and sheep within Australia provides a strong indication of the regional importance of the industries. Around 47 per cent of the national beef cattle herd of 24.8 million head (as at June 2008) is located in Queensland and around 22 per cent of the herd is in New South Wales. The majority of Australia’s 76.9 million sheep (as at June 2008) are located in New South Wales (34 per cent), Western Australia (23 per cent) and Victoria (22 per cent).

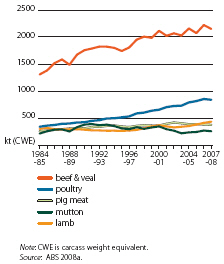

Australian meat production has been increasing over time. From 1984-85 to 2007-08, beef production increased by around 65 per cent and lamb production by 44 per cent. Over the same period the production of poultry and pig meat also increased.

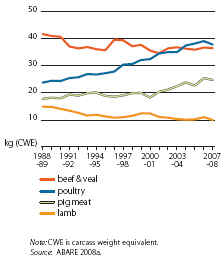

In contrast to production, domestic consumption (per person) of red meat has fallen over the past 20 years. Beef consumption has been quite variable, but has shown an overall downward trend, falling from 42 kilograms a person in 1988-89 to 37 kilograms a jpgperson in 2007-08. Consumption of lamb has also fallen over the same period from 15 kilograms to 10 kilograms a person.

However, the quantity of total meat consumed per person has not changed significantly over time. While the consumption of beef and lamb has declined, the consumption of poultry and pig meat has continued to increase, reflecting changes in relative prices and also changing tastes and preferences.

The increase in the production of red meat in Australia and decline in domestic consumption has led to a greater reliance on export markets. In the late 1980s, less than 60 per cent of beef was exported; this had increased to 64 per cent by 2007-08. For lamb, less than 15 per cent was exported in 1988-89, but by 2007-08 this had increased to 45 per cent. This greater dependence on export markets means the Australian red meat industry is increasingly influenced by global factors.

Australia Compared with Other Countries

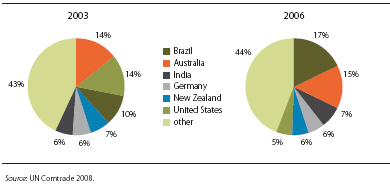

In 2006, Australia was the second largest exporter of beef and veal, after Brazil, accounting for around 15 per cent of world beef exports. Prior to 2005, Australia was the largest exporter of beef.

World beef trade has been constrained over the past few years by disease-related trade restrictions. The discovery of bovine spongiform encephalopathy (BSE) in the United States in December 2003 led to bans, and more recently restrictions, on imports of US beef by Japan and the Republic of Korea. As a result, beef exports from the United States fell in 2004 and have since remained low.

As a result of restrictions on US beef exports to Japan and the Republic of Korea, the demand for Australian beef increased in those markets. Reflecting this, as well as increased production, total Australian beef exports have increased. However, beef exports from Brazil increased by more and by 2006 Brazil was the world’s largest beef exporter.

Australia is also a large exporter of sheep meat, second only to New Zealand in world trade. Although New Zealand has remained dominant, the proportion of world exports coming from Australia increased from 25 per cent to 31 per cent over the 10 years to 2006.

Economic Contribution of the Red Meat Industry

The contribution of cattle and sheep (both slaughtered and exported live) to the total value of Australian agricultural production has varied over time. Over the past 50 years the contribution has ranged from 12 per cent to 29 per cent. The trend over time suggests an increasing contribution of sheep and cattle toward the total value of agricultural production, particularly over the past 10 years.

Beyond the farm level, the red meat industry also contributes to the Australian economy. In 2006-07, the value added for meat processing in Australia was $1973 million.

In addition to meat, there is value derived from co-products. These include offal, tallow, hides and skins, meat meal and other rendered products. Co-products account for approximately 11 per cent of the value of a slaughtered animal (MLA 2009).

The value of red meat exports in 2007-08 exceeded $5.4 billion, with the value of live cattle and sheep contributing an additional $730 million to exports. Combined, the red meat industry and live exports contributed 22 per cent to the value of Australian farm exports in 2007-08.

The red meat industry stimulates expansion of other activities including agricultural, manufacturing and services activities. This is through the use of products and services from these industries to produce and process live animals into beef, mutton and lamb. The extent of these contributions can be examined through the use of an input-output table. An inputoutput table illustrates the flow of goods and services among all sectors in an economy. The latest input-output table for the Australian economy, published by the Australian Bureau of Statistics (ABS), estimates the value of these flows for 2004-05. To allow a simplified and more accurate account of the links of the red meat industry with other industries, the analysis focuses on the meat processing aspect of the red meat sector.

In addition to meat products, the red meat industry produces co-products and by-products such as hides and skins and oils and fats. These products are used as inputs into other industries.

The share of red meat industry products is highest in the bakery industry, accounting for an estimated 11 per cent of the total intermediate input cost. The cost share of red meat industry products is also high in leather manufacturing and in the soap and detergent industries. The oil and fat manufacturing industry is also dependent on the meat processing industry for rendered lard or tallow, with 5 per cent of its intermediate input cost being payments to the meat processing industry.

The red meat industry also plays an important role in the services industry such as retail trade and accommodation, cafes and restaurants. In the case of the accommodation, cafes and restaurants industry, purchases from the red meat industry represent 8 per cent of the industry’s expenditure on goods and services.

The accommodation, cafes and restaurants industry accounted for 32 per cent of total meat sales in 2004-05, followed by the retail trade industry. Together, the two industries accounted for 64 per cent of the value of meat products used by other industries as intermediate inputs. Not surprisingly, the meat industry is affected by changes in accommodation and restaurant activities and retail trade.

Further Reading

| - | You can view the full report by clicking here. |

January 2010