Eye in the Sky: A Global Beef Perspective

In recent years the global beef market has been shaken by unforeseen issues. The rules of the game have already changed. Now is the time for the industry to follow suit - but how exactly will it meet these new requirements? writes Adam Anson, reporting for the Beefsite.New Mouths to Feed

Beneath the surface, the beef export market is in turmoil. Changes in the nature of foreign markets have diverged the flow of business to previously unattainable territories, tightening competition whilst food prices sky-rocket. Crops are no longer merely the domain of food, but are fed to machines to supplement a fuel industry, which is running out of fuel.

Meanwhile the media is rife with stories of an economic Asian boom. New wealth leading to new desires and a growing appetite for meat, but not so far away, in less fortunate countries a food crisis is growing also, and it grows with an appetite for anything.

This global food shortage has created an economic tug of war within the marketplace, with continuing food inflation forecast to resume indefinitely, but the inflation is not mirrored at the producers end and profitability problems are being felt at every level of the animal production sector.

David Evans, an International Beef Industry Consultant told an audience at the EBLEX National Producer Conference that these poor returns are leading to a world wide review of protection to domestic production and food security. The question beckons; in such a volatile marketplace, what is most likely to happen next?

Transactions in a Global Marketplace

To understand how global beef markets are likely to change we must first get to grasps with how they stand today. Currently the United States is by far the largest producer of beef with a huge 11,984,000 tonnes of beef in 2007, but the level of consumption in the US is higher still, totalling 12,746,000 tonnes in the same year. These figures require imports from Australia to balance out, and leave little left for exports, an issue which is compounded further by BSE troubles.

Two other big players in the beef industry - Brazil and Argentina - also tend to eat most of their produce leaving little to export or import. Brazil's production rate varied little over the last couple of years, however Argentina stepped up from 2,553,000 tonnes in 2006, to 2,655,000 tonnes in 2007. Australia, on the other hand, consume relatively little of their beef and instead export a lot to Japan, Russia, Europe and the US. In 2007 exports totalled 1,450,000 tonnes.

The global beef picture -2007

Figures in 000 tonnes

Asia, a continent which has typically eaten very little meat is now beginning to consume much larger quantities as seems to be the pattern with all areas that have a sudden injection of wealth. Japan and South Korea in particular are consuming much greater quantities at an increasing rate.

Russia, unable to produce enough beef, are one of the largest importers. Accepting a lot of trade from Brazil, and once again, Australia. Imports in 2007 stood at 960,000 tonnes

The EU remains a large global player, consuming a lot, producing a lot and importing a lot. However rates have decreased on all issues except for imports.

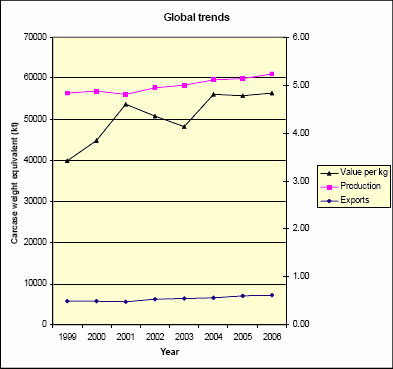

According to Mr Evans global trends have risen in beef value, beef production and beef exports. Production rates have consistently increased, save for a slight lapse in 2001. However, the value of beef has suffered far greater turmoil, soaring up until 2001 and then dipping back down for two years before rising up again. In spite of this it is beef prices that have increased the most, whilst exports started low and varied only slightly.

Following Trends in 2007

All the evidence points to an increased global trend of consumption, leading to increased production, which will invariably require greater demand for available land to produce on. Unfortunately, this is not quite so straightforward as it seems.

Where Will All the Cattle Go?

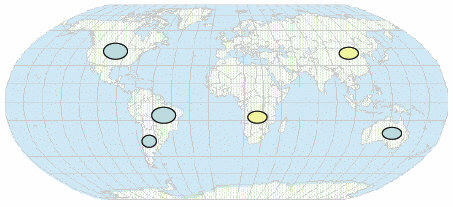

As Dr Evans pointed out beef production is confined to area that have a comparative advantage. For example, the area used to raise cattle must have a temperate climate without great fluctuations in heat. These are generally held within the subtropical, or tropical, regions, but not so far north or south of these boundaries. Also, livestock is usually raised on land that is not suitable for other, more profitable, forms of agriculture.

Dr Evans informed us that possibly emerging areas of production were in South Africa and the massive grasslands of Mongolia. Unfortunately there is the issue of infrastructure and transport to contend with and on top of that producers need to have a ready supply of feed nearby. As the cost of feed is already so high many producers are constrained to the economic benefits of grassland. Although there is potential in these areas it asks an unrealistic question that they might provide for the huge increase in consumption forecast.

Areas Compatible to Producers

When all the factors are considered it becomes evident that there are great limitations on land that is ideally suited for cattle production and most of this land is already being used for that purpose.

Different Palettes Different Desires

Dr Evans added that the future isn't determined solely by production rate, but also production type. The successful company must cater for the changing face of consumer desires. In the West beef consumption is in decline and an increasing trend towards mince and diced products is taking its place.

Go to Asia and you will witness a rapidly growing market for diced/sliced and processed beef. However, in East Europe 'just about all the beef goes into sausages', said Dr Evans, whilst the Islamic cultures favour beef and lamb, with a preference for processed meat used for meatballs.

Tough Times Ahead

The offshoot of these new issues is that countries are increasingly looking to protect domestic producers in order to stimulate their own production. There has also been an increase in consumer protection, protecting them from price increases in the rest of the world.

There is no easy path for the future of beef, concluded Mr Evans. Continued difficulty in world trade negotiations will not be helped by the current situation.