US Beef and Dairy Outlook Report - May 2008

By U.S.D.A, Economic Research Service - This article is an extract from the May 2008: Livestock, Dairy and Poultry Outlook Report.

Beef/Cattle: Deteriorating pasture and range conditions over much of the Plains and increasing livestock production costs are adversely affecting all cattle and beef sectors. Smaller inventories of U.S. cows, calf crops, and feeder cattle are likely in 2009 because of relatively heavy cow slaughter and apparent low levels of heifer retention thus far in 2008. Continued high demand for corn will likely lead to higher corn and feed prices, with declining profit margins, for most of 2008.

Beef/Cattle Trade: Exports are expected to increase at a faster rate with the market reopening in Korea. Beef imports are expected to drop in 2008, but pick up in 2009. The weak dollar and heavy cow slaughter will affect imports in 2008. Lower cow slaughter in 2009 will cause imports to increase next year.

Dairy: Milk production is forecast to rise only slightly in 2009. Exports on both a fats and skims/solids basis will be lower next year, limit domestic commercial use, and keep prices firm for most dairy products.

Beef/Cattle

Higher Feed Costs and Lower Cattle Inventories Likely Ahead

Farmers intend to plant 8 percent less corn acreage in 2008 than in the 2007 growing season. Corn is still the major ethanol feedstock in the United States. Increased demand for corn, due to Federal mandates for increased ethanol production, mean livestock producers will face higher prices for corn and other feeds. Along with the increased demands for corn for ethanol and feed, weather will be a significant factor in determining cattle and beef price movements for the remainder of 2008. The current outlook for 2008 and 2009 assumes normal precipitation patterns, but Corn Belt corn planting has been delayed due to wet soil conditions. At the same time, dry conditions are evident in the short-grass areas of the Plains States, and dry conditions persist in the Appalachian region.

Total January 1, 2008 cow inventories registered declines to levels not observed since the mid-1950s. Even with normal precipitation patterns during 2008, inventories could be smaller on January 1, 2009 than January 1, 2008, because high rates of cow slaughter during the latter half of 2007 appear to be continuing into the first half of 2008, even after accounting for imports of slaughter cows from Canada that resumed in November 2007. Dry conditions in the major cow-calf areas mentioned above and declining cow-calf profit margins, due to falling calf prices and increasing production costs, are supporting the cow slaughter rate. Calf crops will shrink accordingly, which will translate into smaller inventories of feeder cattle for placement in feedlots in 2009 and 2010. Beef cow slaughter rates should moderate and exhibit more normal patterns as pastures begin to develop this spring. Dairy cow slaughter rates, having returned to more typical patterns in late 2007, should average slightly above historical rates. Cow prices have also received help from the weak dollar, which has made imported beef more costly, so that the heavy rates of commercial cow slaughter have have had little negative effect on cow prices.

Smaller supplies of feeder cattle as a result of smaller calf crops in 2008 and 2009 and retention of heifer calves for cow-herd replacement could lead to reduced veal production in both years. Currently, relatively large numbers of veal calves are being slaughtered at light weights. As a result, veal production is running about 15 percent below year-earlier levels, although calf slaughter is only a few percentage points below year-earlier, as measured on a weekly basis through May 9, 2008. If pasture-related demand for feeder calves materializes this spring, higher prices for scarce supplies of feeder cattle could result in a shift of end-use of dairy calves for veal production to their being raised as stocker cattle that eventually enter feedlots and are marketed as fed cattle. This could lead to increased average veal slaughter weights and reduced veal slaughter as dairy calves move into stocker channels.

Higher feeding costs will lead to larger cattle-feeding losses and reduced demand for feeder cattle from the feedlot sector. As we move toward 2009, there may be opposing pressures on feeder cattle prices, especially prices for lighter weight feeder cattle, as upward price pressure from pasture demand offsets downward pressure from declining demand from cattle feeders for increasingly scarce supplies of feeder cattle.

Beef will likely face increasing competition at the retail meat counter from ample supplies of competing meats, which will continue to exert downward pressure on prices for wholesale beef and fed cattle, further exacerbating cattle-feeding margins. Slaughter weights will likely continue above last year’s levels, at least for the next few months. In the near term, fewer cows and heifers in the slaughter mix will lead to increased average slaughter weights because heavier steer carcasses will make up a larger proportion of the mix. As Canada shifts into a mode of exporting over-30- month cattle, cull cow imports from Canada will replace some U.S. imports of Canadian slaughter steers and heifers. Because Canadian cattle are generally heavier than U.S. cattle, the decline in imports of Canadian slaughter steers and heifers will result in slightly reduced average U.S. steer and heifer slaughter weights. The potential for heavier slaughter weights will also be offset by the effects of slightly premature marketing of fed cattle at slightly lower final weights.

Factors that will induce premature marketing include (1) increased heifer retention and its effects on feeder cattle supplies outside feedlots available for placement in feedlots and (2) expected higher beef prices due to fewer cattle going to market. Factors mitigating the foregoing and its positive price effects include (1) ample supplies of competing meats at relatively attractive prices, (2) adjustments in veal slaughter from more dairy calves going into stocker and feeding programs, and (3) cattle imports from Mexico and Canada that will feed into U.S. beef supplies. As a result, beef production, at 26.7 billion pounds, will be slightly higher in 2008 than in 2007. Beef production in 2009, at 26.4 billion pounds, is forecast to be lower than in 2008.

Beef/Cattle Trade

Beef Exports Expand after Agreement with Korea

Beef exports for 2008 are expected to be 1.645 billion pounds, a 15-percent increase from 2007. The reopening of the Korean market to U.S. beef will provide a substantial boost to exports. The agreement will allow approved U.S. plants to export bone-in and boneless products to Korea, provided they meet specific requirements for the handling of Specified Risk Materials (SRM), requirements that are in line with domestic regulations. Furthermore, with the FDA’s announcement of a final rule for an extended feed ban on ruminant meat-and-bone meal, Korea will accept U.S. beef from animals over 30 months of age. The agreement allows beef from animals imported from Mexico, as well as beef from cattle imported from Canada that have been raised in the United States for over 100 days, to be sold in Korea. After the initial 90 days of the new agreement, Korea will accept USDA inspection and monitoring of eligible packing plants.

Demand for U.S. beef in Korea is expected to be strong, as evidenced by the summer and fall of 2007 when eligible products were more limited and the market was only open for short periods. While it may take several years for exports to reach levels seen before the first confirmed U.S. case of BSE in 2003, trade is expected to resume quickly. For the first time since 2003, popular beef cuts from the United States, such as short ribs, will be able to enter the Korean market. Once U.S. beef was no longer available, the demand for these items was never fully met, resulting in higher prices. The reintroduction of U.S. beef should lead to lower prices in Korea. The potential price shock could cause an initial spike in U.S. exports as Korea builds stocks of U.S. grain-fed beef, followed by gradual growth. Beef exports to all destinations are expected to grow 14 percent in 2009, to 1.87 billion pounds.

Beef Imports To Fall in 2008, Pick Up in 2009

Beef imports in 2008 are expected to be 2.815 billion pounds, an 8-percent decrease from last year. Domestic supplies of processing beef will be high as heavy cow slaughter continues. The weak U.S. dollar will also keep imported beef relatively more expensive, further discouraging foreign beef. However, with a lower cow slaughter in 2009, imports are expected to increase 7 percent to 3.01 billion pounds. After several months of more normal precipitation in Australia, recent dryness has led to hesitation in herd rebuilding. If there is a return to normal weather, increased heifer retention and decreased cow slaughter would limit the amount of beef available for exports in the short-term. Weather will remain a factor in Australian slaughter and export levels. The U.S. agreement with Korea could lead to the displacement of Australian beef going to Korea, some of which would be redirected to the United States.

Imports from Canada have been below historical totals, according to both weekly AMS reports and official U.S. Census data. High feed costs, difficulties in the Canadian packing industry, and a strong Canadian dollar have hurt their beef exports. Live cattle have been exported to the United States for finishing and slaughter, rather than the finished beef products.

Dairy

Milk Equivalent Exports Now Reported as Separate Item in Tables; Commercial Use More Closely Reflects Domestic Use

Despite higher feed costs, milk production continues to rise, and the rate of increase this year will be 2.3 percent higher than in 2007. Current-year production is projected to be above 2007, at 189.8 billion pounds. Milk production is forecast to rise by only 0.3 percent, to 190.4 billion pounds in 2009. The effect of this year’s soaring feed costs on cow numbers likely will not be apparent until 2009. Milk cow population will rise in 2008 to 9,265 thousand, before declining incrementally to average 9,230 thousand in 2009. A slowing of growth in California due to production restrictions by cooperatives there, limited possibilities of exporting cows to nearby States, and continuing exits in Eastern and mid-Western States is the source of the pullback. Milk yields per cow have been increasing at a slower rate for several years. They will climb by 0.8 percent in 2008 after adjusting for the extra day in February and are forecast to rise less than 1 percent in 2009, to 20,630 pounds. The milk-feed price ratio could become more favorable toward the end of 2009, mostly because of higher milk prices rather than because of any expected declines in feed costs.

U.S. demand for dairy products continues to be relatively strong, and exports, which are now broken out as a separate item in USDA tables, continue to show substantial growth on a fats basis. However, skim/solid exports are expected to be lower. Although European Union (EU) production is expected to continue to rise, most of the added milk will be consumed within the EU, especially in Eastern European countries where incomes continue to advance. Diminished dairy product availability from Oceania and other regions, and the lower valued dollar, combine to make the United States an increasing source of global dairy products, especially cheese. However, exports in 2009 are expected to drop from 2008 totals as competitors’ milk supplies recover and leveling of domestic production increases competition between exports and domestic use.

Continued increases in exports will likely keep cheese and butter prices firm in 2008. Consequently, commercial use, which now more closely gauges domestic use, is projected to rise about 2 percent in 2008 over 2007, but is forecast to rise only slightly more than 1 percent in 2009. Production is moving more toward butter/powder at the expense of cheese as cheese production capacity is limited. Commercial stocks on both a fats and skims/solids basis are expected to be significantly tighter by the end of 2009 than in 2008. National Agricultural Statistics Service cheese prices will likely average $1.820 to $1.870 per pound in 2008 and level to an average $1.790 to $1.890 per pound in 2009. Butter prices are forecast to average $1.335 to $1.415 per pound this year and rise to $1.335 to $1.485 in 2009. Nonfat dry milk (NDM) price has fallen in 2008 compared with last year and will likely average $1.360 to $1.400 per pound. However, prices are forecast higher in 2009, at $1.470 to $1.540 per pound. Whey prices for 2008 are sharply lower than in 2007, and by year’s end will average 27.5 to 30.5 cents per pound. Only a slight recovery is expected in 2009, to 29.5 to 32.5 cents per pound.

The impact of higher product prices will push milk prices higher in 2009 after a decline in 2008. The Class III price is expected to average $17.00 to $17.50 per cwt in 2008 and to average $16.80 to $17.80 per cwt in 2009. The Class IV price this year is expected to average $15.45 to $16.05 per cwt and climb to $16.50 to $17.60 per cwt in 2009. The all milk price, lower in 2008 than in 2007, will average $17.95 to $18.45 per cwt, and will rise slightly in 2009 to average $17.90 to $18.90 per cwt.

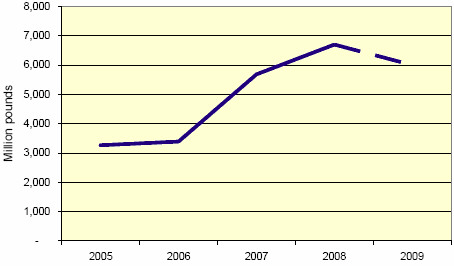

Milk equivalent exports: fat basis

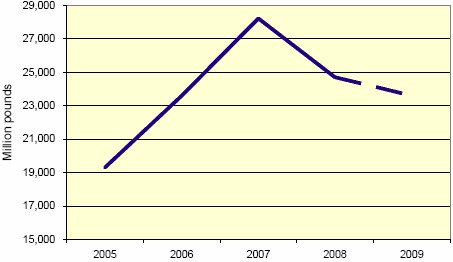

Milk equivalent exports: skim solids basis

Further Reading

| - | You can view the full report by clicking here. |

April 2008