US Beef and Dairy Outlook Report - April 2008

By U.S.D.A, Economic Research Service - This article is an extract from the April 2008: Livestock, Dairy and Poultry Outlook Report.

Contents

Cattle/beef trade: Beef imports are expected to fall for the fourth straight year. Exports will continue to expand, but at a more moderate pace than previous years. Live cattle imports and exports are both projected to increase in 2008.

Dairy: Feed prices are higher thus far in 2008 and are expected to remain so for the rest of 2008. Milk production will continue to rise slightly this year, as exports buoy demand and price declines from 2007 are moderate.

Cattle/Beef Trade

Beef Imports Expected To Fall in 2008

U.S. beef imports are expected to be 2.93 billion pounds in 2008, a 4-percent decline from 2007. Both foreign and domestic factors will play a role in the lower import numbers. Domestic cow slaughter is expected to remain relatively high in 2008, meaning high domestic supplies of processing beef and lowered demand for foreign beef. A weak U.S. dollar and opportunities for traditional foreign suppliers in other global markets, particularly Europe, Russia, and China, has made exporting beef to the U.S. less attractive.

U.S. beef exports are expected to be 1.515 billion pounds in 2008, a 6-percent increase from 2007. Despite the weak dollar, countries that rapidly expanded beef imports from the United States last year, such as Japan and Canada, have not continued to expand at the same rate so far this year. According to the USDA’s Export Sales Reports, exports have remained strong in the first quarter for Mexico and historically smaller markets, in particular Vietnam.

Live Cattle Trade Increasing for Both Imports and Exports

Live cattle imports into the United States continue to be high, with 2.65 million head projected to cross the border in 2008, a 6-percent increase from 2007. Feeder cattle imports from Canada continue to be above the previous year’s levels, according to AMS weekly reports, while Canadian slaughter cows and bulls continue to enter the United States at fairly constant levels after being prohibited until November 19, 2007. Dry conditions in Mexico may lead to difficult grazing conditions and increased exports to the United States. However, weekly reports do not indicate weather-related increases in imports yet.

Live cattle exports from the United States are also expected to increase considerably in 2008, a result of more cattle entering Mexico due to regulations implemented at the end of last year in that country regarding importation of dairy cattle. The 2008 forecast for live cattle exports is 90,000 head, almost a 40-percent increase from 2007.

Dairy

Milk Production in 2008 Is Expected To Rise Despite Soaring Feed Prices

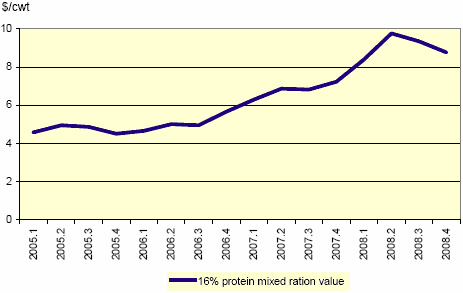

Feed prices are expected to climb higher in 2008, as 8 percent fewer acres of corn are forecast to be planted, and soybean acreage is expected to jump 18 percent. Of importance to the dairy industry are higher prices for alfalfa hay. According to the March Prospective Plantings report, producers intend to harvest 2 percent fewer total hay acres in 2008. The rising ingredient prices could push the benchmark 16- percent-mixed-ration price up 33 percent from 2007, which in 2007 was up 34 percent from 2006. Despite this, the milk herd size is expected to continue to increase slightly in 2008. Milk production is projected at 190.0 billion pounds in 2008 as output per cow climbs less than 1 percent on a per day basis 2007. This year-over-year increase is the smallest in about 3 years.

Production has not buckled under high feed prices because herds are continuing to expand in response to last year’s favorable returns. Milk prices have been declining and demand for dairy products remains relatively strong. Commercial use in 2008 is expected to exceed that of 2007 in each of the four quarters and average 3 percent above 2007. Domestic demand appears steady as consumers adjusted to substantially higher prices in 2007. Cheese and butter prices are expected to be higher in 2008.

Exports have helped boost demand. While dry products have traded briskly in recent years, now cheese and butter are being exported in larger quantities. In the fourth quarter of 2007, butter exports ranged at between 14 and 16 percent of total production. February butter and butter product exports also exceed 11 percent of production. For the most recent 2 years, butter exports have been between 2 and 4 percent of total production. Likewise, cheese exports in 2007 have exceeded those of recent years and reached nearly 3 percent of total production in January 2008. These higher export trends are expected to continue in 2008. While the European Union increased milk production quotas by 2 percent in April 2008, most of any increased production will likely be directed to internal demand. Although Australia appears to be recovering from drought, production this season is still expected to be below last year. Robust global demand for dairy products and limited supplies in the rest of the world provide a basis for strong U.S. export sales for the remainder of 2008.

Stocks on a milk-equivalent fat basis were higher in 2007 than in recent years and are expected to climb slightly by the end of 2008 to 10.5 billion pounds. Likewise, stocks on a skim-solids basis will likely climb slightly to 10.0 billion pounds by year end. These stocks do not appear burdensome and falling interest rates lower the cost of holding stocks.

Prices for cheese and butter are expected to be higher in 2008. Cheese could be substantially higher as supplies remain tight. Cheese prices are expected to average between $1.775 and $1.825 per pound in 2008, above $1.738 per pound in 2007. Although butter supplies appear ample, availability could tighten later in the year, firming prices, especially if exports maintain their recent pace. Butter price is projected to average $1.310 to $1.390 per pound this year, compared with 2007’s average of $1.344 per pound. Declines are expected for nonfat dry milk (NDM) and whey.

NDM prices are expected to average $1.360 to $1.400 per pound and whey prices 27.5 to 30.5 cents per pound in 2008. In 2007, average prices for these products were $1.708 and 60.0 cents per pound, respectively. Despite firm product demand, slightly higher production is forecast to tip milk prices lower. The Class III price is expected to average $16.55 to $17.05 per cwt in 2008 and will average above the Class IV price this year in contrast to last year’s situation. The Class IV price is expected to average $15.35 to $15.95 per cwt. The all milk prices will be lower in 2008, averaging $17.65 to $18.15 per cwt.

USDA benchmark feed price soars

Further Reading

| - | You can view the full report by clicking here. |

April 2008