US Beef and Dairy Outlook Report - January 2008

By U.S.D.A., Economic Research Service - This article is an extract from the January 2008: Livestock, Dairy and Poultry Outlook Report, highlighting Global Poultry Industry data.

Summary

Beef/Cattle - Inadequate winter pasture conditions and high feed costs continue to motivate cow slaughter and placements of feeder cattle in 1,000-plus feedlots. As a result, inventories, placements, and marketings of fed cattle during 2008 could vary from typical seasonal patterns.

Trade - Increased U.S. cow slaughter and a weak U.S. dollar are affecting the demand for foreign beef in the United States. Canadian cattle continue to be imported to the United States as Canadian market conditions make the United States more attractive for feeding cattle and producing beef.

Dairy - Higher feed costs are expected to limit diary production expansion in 2008. Domestic and export demand for cheese will likely keep milk prices from falling precipitously.

Cattle/Beef

Winter Forage Conditions Send Cows to Slaughter and Calves to Feedlots

While some much-needed precipitation has fallen in areas of the Southeast and Southern Plains States, it is too late to produce much cool-season forage or wheat pasture for cattle for the remainder of the winter. It will, however, be of some value for Spring and Summer pastures, wheat, and other grain crops in 2008. Rising fuel prices, reported inadequate supplies of some fertilizers, large inventories of hogs and poultry, and a deteriorating domestic economic outlook are additional factors exerting negative pressures on the cattle and beef sector.

Although dairy cow slaughter appears to be moderating during the last part of December, apart from holiday effects, weekly total Federally inspected cow slaughter continued at relatively heavy rates during December 2007, above last year’s heavy rates during the corresponding periods. These continuing high rates of cow slaughter reflect the lack of pasture forages in the Southeast and Southwest and the relatively high prices producers face for harvested forages and protein supplements this winter. January 1, 2008 cow inventories, especially beef cow inventories, to be reported in the upcoming National Agricultural Statistics Service’s Cattle report may be reduced due to these rates. There is some speculation that heifers are being retained, replacing the cows going to slaughter, because they generally require less feed and pasture. Heifers often have the bonus of being genetically capable of producing higher quality calves than the cows they replace.

Feedlot placements were significantly higher in November 2007 than industry analysts had expected, especially in the lighter weight categories, and could be followed by heavy placements in December for the same reasons—lack of winter pastures and no lower cost options for providing homes for these calves for the remainder of the winter. In a normal year, a portion of calves born in the spring would be placed on wheat pasture after weaning, where they would remain until reaching feedlot placement weights in mid-March, or as late as May if wheat were grazed out. Placement of these calves in feedlots would normally have been spread throughout the winter and spring of 2008 as they came off cool season pastures, especially wheat pasture. Prospects for grazing on wheat pasture declined as wheat prices increased this fall, and prices for wheat are currently high enough that there is not likely to be wheat pasture available for graze-out this spring. Under present conditions, the greater fall placements will likely shift some fed cattle marketings ahead of a normal schedule, with some of these cattle likely to be marketed earlier in the year than is consistent with typical seasonal patterns. This shift is more likely if January 1 cattle-on-feed inventories in feedlots of 1,000-plus head are much over last year’s record 11.8 million head.

This shift in marketings could also affect the percentage of cattle grading Choice or better because they will have been in feedlots during the winter months when gains are poorer with feed being utilized by the animal for maintenance of body condition rather than for growth. A lower percentage of cattle grading Choice or better could affect trade by necessitating the importation of more fed cattle, fed beef, and/or trimmings from Canada, or less processing beef from Australia, New Zealand, Uruguay, and other sources.

Reduced slaughter through the holiday period allowed wholesalers to reduce some inventories, providing at least a temporary boost to beef cutout values. Cutout values for Choice dressed beef increased somewhat in December 2007 compared with November 2007. The spread between Choice and Select beef cutout values is narrowing seasonally, after reaching a weekly peak of just over $16 in the first week in December. The seasonal decline in the Choice-Select spread occurs as the percentage of steer and heifer carcasses grading Choice and Prime, the two highest grades for beef, climbs toward its seasonal winter peak, a result of seasonally better feeding conditions during the previous summer and fall than during the winter.

Farm-to-wholesale spreads declined as December 2007 retail prices for Choice beef were slightly lower than November 2007 prices. While fed cattle prices through December 2007 were 3 percent below November 2007 prices, recent declines— should they continue—combined with recent declines in the per unit byproduct values, will not improve farm-to-wholesale spreads. Negatives for beef prices at the retail counter include the deteriorating domestic economic outlook for the near term and plentiful supplies of competing meats.

Beef Trade

Increased Domestic Cow Slaughter Reducing Demand for Foreign Beef

Increased U.S. cow slaughter rates, relatively low domestic beef and cow cutout prices, and a weak U.S. dollar have impacted beef imports into the United States. Import forecasts were lowered to 3.16 billion pounds in 2007 and 3.34 billion pounds in 2008. According to U.S. Customs, imports from Canada and New Zealand have shown significant declines in the last quarter compared with last year’s fourth quarter. Higher rates of cow slaughter increase the supply of processing beef, which makes up the majority of imported beef. Combined with a weak U.S. dollar, the demand for imported meat overall has fallen.

Commerce and Customs data also indicate that imports from Uruguay slowed in the last quarter. However, imports of Uruguayan beef in the second and third quarters of this year were well above last year, leaving imports in the fourth quarter to be squeezed by the Tariff Rate Quota schedule. Additional imports in the fourth quarter would have been assessed a higher tariff rate. The higher cost of selling additional beef in the U.S. market, combined with a depreciating dollar relative to the Uruguayan Peso, most likely discouraged imports in the fourth quarter. The TRQ’s entry levels reset with the new year, and Uruguayan imports could improve despite the weak dollar and a decrease in demand for processing beef.

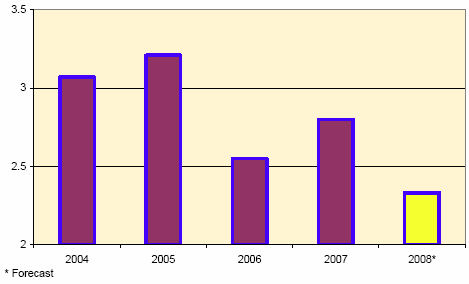

November Commerce data and weekly AMS reports in December show Canadian cattle entering the United States well above last year’s levels. High feed costs in Canada, a tight labor market for Canadian packing plants, and a relatively strong Canadian dollar continue to give the United States a comparative advantage in feeding and producing beef, affecting the imports of both feeder and slaughter cattle. Three-and-a-half times as many feeder cattle crossed the Canadian border in the last 12 full weeks of 2007 compared with the previous year, according to the weekly reports. Total cattle entering the United States are forecast at 2.475 million head for 2007.

The weak U.S. dollar has facilitated beef exports to Canada and small quantities going to nontraditional trading partners, such as Moldova and Vietnam. The exports to smaller countries have offset some of the trade lost due to the inability to sell U.S. beef products in Korea at the end of 2007. Forecasts for 2007 are 1.404 billion pounds, while forecasts for 2008 remained unchanged at 1.71 billion pounds.

Dairy

Despite Higher Feed Costs, the Milk Production Expansion Continues

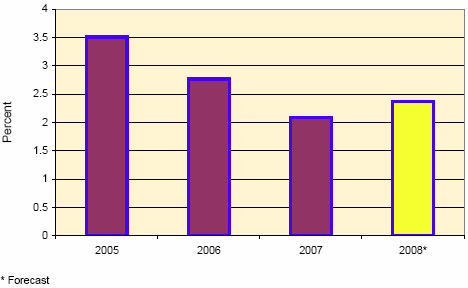

USDA projects 2007/08 corn and soybean meal prices at $3.70 to $4.30 per bushel and $305 to $335 per ton, respectively. The higher feed prices, coupled with expected continuing tight supplies of alfalfa hay, have pushed the expected milkfeed price ratio below 2.50 for most of 2008. Dairy cow slaughter for January- November 2007 is slightly ahead of the same period for 2006 according to December’s Livestock Slaughter report. Replacement heifer prices remain relatively high, and imports from Canada are brisk. This suggests freshening of the herd, which would boost feed productivity and lower unit costs. Forecast 2008 cow numbers are reduced slightly in the last half of 2008. Moreover, higher feed prices could slow the growth in milk per cow by the second half of 2008. The lowered average age of the dairy herd should help the leading producers persevere against higher feed costs. USDA projects 2008 milk production at 190.0 billion pounds, up 2.3 percent from 2007’s expected production.

Cheese prices on the Chicago Mercantile Exchange have been volatile of late. The National Agricultural Statistics Service reported U.S. barrel prices over $2.12 per pound and blocks over $1.99 per pound during the week ending December 29th. USDA forecasts 2008 cheese prices to peak in the first quarter of the year and then decline to average $1.645 to $1.725 per pound, just below 2007’s average of $1.738, with higher expected milk production this year and relative product prices likely favoring increased cheese production. Cheese prices should remain relatively high by historical standards because cheese exports are expected to remain strong, stocks are moderate, and production is limited. Cheese exports climbed to over 2.5 percent of total production through October and are expected to remain strong in 2008 because of the weak dollar and because the economies in buying countries, many of whom are energy exporters, remain strong. December’s Cold Storage report places total cheese stocks at the end of November at 785,359 pounds, virtually unchanged from the same period in 2006, and 9 percent above the 5-year average for the end of November. The January Dairy Products report placed November production 1.2 percent behind that of a year earlier.

Butter prices have tumbled from their third-quarter highs to average $1.3012 per pound for the fourth quarter. The butter price in 2008 is expected to remain in the $1.195 to $1.305 per pound range for the year. Monthly butter production through November exceeded that of 2006 in most months, especially in the second half of the year, in some months by double digits. Stocks were a third higher at the end of November 2007 compared with a year earlier. Lower prices could buoy exports which have recently accelerated and help draw down stocks in 2008.

Exports of nonfat dry milk (NDM) and skim milk powder (SMP) declined in 2007 by nearly 13 percent from the 2006 level, and commercial stocks as of the end of November were 227 percent above the corresponding period in 2006. Exports had been down by larger percentages throughout most of 2007, but exports of NDM/SMP to Mexico in November totaled 9,891 tons, the largest since October 2005, and exports to that important market are now up for the year.

As a result, it appears that stocks may be declining, and exports may be picking up.While prices have sharply declined from 2007 peaks, they should average $1.580 to $1.640 per pound for 2008. Similarly for whey, prices have fallen, but there appears to be support in the 40-cent-a-pound range. At that price, whey may price itself into other than food uses. The whey price is forecast at 43.0 to 46.0 cents a pound.

The softening in dairy product prices translates into lower prices for milk in all classes in 2008. The Class IV price is forecast at $16.80 to $17.70 per cwt, substantially below 2007’s average of $18.36 per cwt. The Class III price is expected to decline to $16.15 to $16.95 per cwt, down from 2007’s $18.04 per cwt average. The all milk price is forecast to average $17.90 to $18.70 per cwt, a drop from $19.15 in 2007.

Further Reading

|

|

- You can view the full article by clicking here. |

January 2008