When Will Cattle Finishing Be Profitable Again?

US monthly fed cattle net returns have been negative since December 2014. A few months ago, it appeared that we would climb above breakeven this spring, writes Michael Langemeier, Center for Commercial Agriculture, Purdue University, in Farmdoc Daily.However, that was before the recent drop in fed cattle prices. Using data from the Livestock Marketing Information Center (www.lmic.info), fed cattle prices in Kansas dropped from $135.93 per cwt. for the week ending on March 27 to $123.84 per cwt. for the week ending May 1.

What has this done to the prospects for breaking even in the near term? This article discusses trends in feeding cost of gain and net returns for steers finished in Kansas, and the relationship between projected fed cattle prices and breakeven prices for upcoming months.

Several data sources were used to compute net returns. Average daily gain, feed conversion, days on feed, in weight, out weight, and feeding cost of gain were obtained from monthly issues of the Focus on Feedlots newsletter. Futures prices for corn and seasonal feed conversion rates were used to project feeding cost of gain for the next several months. Net returns were computed using feeding cost of gain from monthly issues of the Focus on Feedlots newsletter, fed cattle prices and feeder cattle prices reported by the Livestock Marketing Information Center (LMIC), and interest rates from the Federal Reserve Bank of Kansas City.

Figure 1 illustrates monthly feeding cost of gain from January 2006 to February 2016.

Feeding cost of gain averaged $85.16 per cwt. in 2015. This is certainly a welcome departure from the high feeding cost of gains experienced during most of the 2011 to 2014 period.

Feeding cost of gain exceeded $90 per cwt. from April 2011 through September 2014, and $100 per cwt. from August 2011 to December 2013. Given current corn and alfalfa price projections, feeding cost of gain is expected to range from $75 to $80 for the rest of 2016.

.jpg)

Monthly steer finishing net returns from January 2006 to February 2016 are presented in Figure 2. It is important to note that net returns were computed using closeout months rather than placement months.

After a profitable run from October 2013 to November 2014, losses have been the norm. Average losses in 2015 were $247, and ranged from $56 per head in January to rather incredible losses of $498 per head in November and $521 per head in December.

Obviously, something went amiss in late 2015. Fed cattle prices dropped from $142.97 per cwt. during the first full week of September to $120.14 for the first full week of October.

Just as important, fed cattle prices for the last four months of 2015 were substantially below the expected fed cattle prices when the feeder cattle sold during these months were purchased.

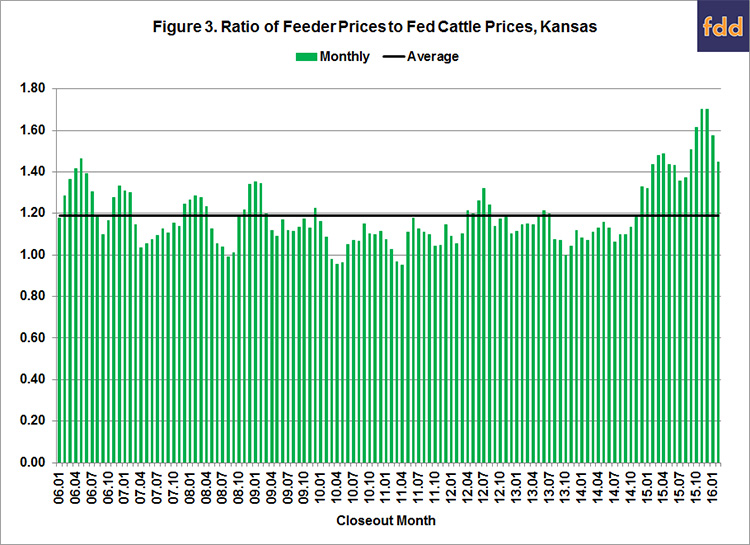

One way to visualise this is to compute and plot the ratio of feeder prices to fed cattle prices.

Figure 3 illustrates the ratio of feeder prices to fed cattle prices from January 2006 to February 2016. The average ratio over this period was 1.189.

The ratio was one standard deviation below (above) this average for 10 (19) months during the ten-year period. The average net return for the months in which the ratio was below one standard deviation of the average was $87 per head.

In contrast, the average loss for the months in which the ratio was above one standard deviation of the average was $240 per head. Of the 19 months with a ratio above one standard deviation of the average, 13 of the months occurred from February 2015 to February 2016.

.jpg)

Now let's take a look at what has occurred so far this year, and make some projections for the rest of the year.

Losses in January and February were $362 and $198 per head, respectively. For March and April, losses per head are estimated to be $135 and $105.

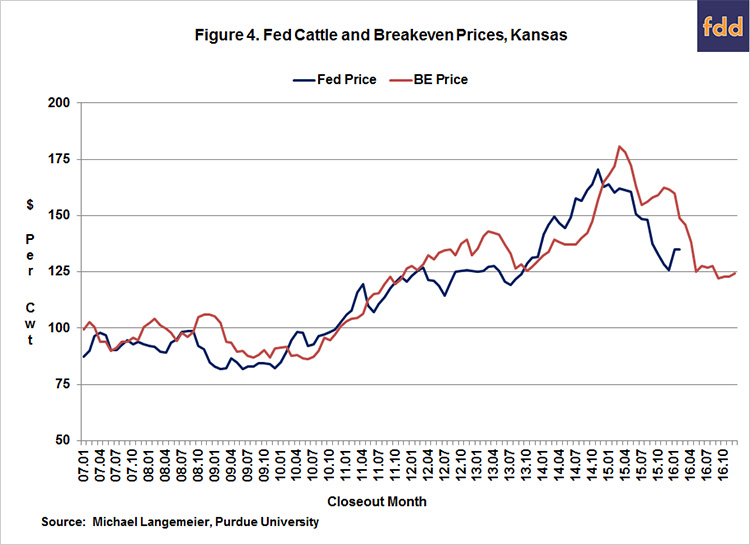

Fed cattle prices and breakeven prices are illustrated in figure 4. Breakeven prices for May and June are expected to range from $125 to $127 per cwt. These breakeven prices are below the current projected fed cattle prices from LMIC for the second quarter ($130 to $132 per cwt.).

Breakeven prices for the third and fourth quarter of 2016 are expected to range from $123 to $127 and $122 to $125, respectively.

Are these breakeven prices low enough for cattle finishers to earn a positive return? The answer depends on two factors: feeder prices and fed cattle prices. If cattle finishers are cautious when buying feeders during the next few months and current price projections are realised (both big ifs), cattle finishers will either be close to breakeven or earn small net returns.

This article discussed recent trends in feeding cost of gain and cattle finishing net returns. Losses have declined from the levels experienced in late 2015.

Moreover, given current price projections, it appears that we will be close to breakeven in May and June of this year. Breakeven prices for the last two quarters of 2016 are currently slightly below current price projections.

Citation: Langemeier, M. "When will Cattle Finishing be Profitable Again?" farmdoc daily (6):87, Department of Agricultural and Consumer Economics, University of Illinois at Urbana-Champaign, May 6, 2016.