What Will Drive the Next Beef Herd Expansion?

The practicalities of US herd expansion, and some of the main constraints, are explored by Dr. Kenny Burdine and Dr. Greg Halich, University of Kentucky.With cattle inventory at levels not seen since the early 1960's and a massive corn crop in the bin from 2013, it seems appropriate to evaluate the future of US cattle numbers, writes Drs Burdine and Halich.

Numerous factors have affected cattle numbers over the last several years and undoubtedly those, and many more, will determine when we start to see expansion of the US cow-herd.

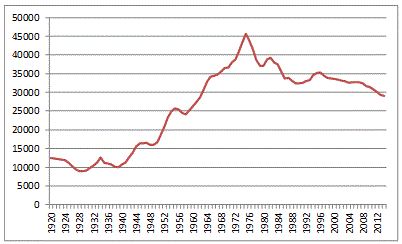

The chart to the left depicts USDA-NASS January 1 beef cow numbers from 1920 to 2014. While there has been obvious variation in inventory from year-to-year, a clear upward trend can be seen from the 1930's to the mid-1970's, followed by a sharp and then more gradual reversal that has continued until today.

Beef Cow Numbers in the US 1920 -Today

When thinking about cow herd expansion, it important to note that no single factor drives an individual producer's decision to expand or reduce the size of their cow herd. Producers respond to a wide array of market signals and operate within a wide range of constraints. The purpose of this article is to discuss some key factors that will likely impact producer decisions to expand their herds over the next few years.

Expansion Occurs at the Cow-Calf Level

This should be obvious, but it is sometimes easy to forget that the beef cattle sector remains one of the most segmented in all of agriculture. While there are examples of vertical integration in the beef sector, it is still primarily comprised of a large number of independent operations and this is especially true at the cow-calf level.

While feedlot profitability and retail beef prices are certainly important to the overall beef system, expansion can only occur at the cow-calf level. These factors only impact cow numbers when signals are sent back through the segmented beef system and cow-calf operators choose to hold heifers.

Collectively, it is the cow-calf industry that determines the number of cows in production and the number of calves that hit the market each year.

Producers Respond to Profits, Not Prices

Often it is assumed that producers expand when prices reach a certain level, but this is an oversimplification. Prices don't tell us any more about profitability than one's income does about their financial status.

Costs matter just as much. While it is true that calf and feeder cattle prices are at historically high levels, it is also true that production costs have also risen dramatically. In order for the market to send an expansionary signal to producers, it is not enough that prices rise. Prices must rise by enough to translate to increased profits at the cow-calf production level.

Breeding Stock is a Long-term Capital Investment

Too often we discuss cow-calf operations as though they make decisions year-to-year, when expansion decisions take a long-term outlook. Cows are likely to remain in production for ten years or more. When a producer purchases additional bred heifers (or holds back their own heifers), they make an investment that requires multiple years to pay back.

Ultimately, breeding stock is an asset that requires a significant upfront cost, yields a return over the course of some productive life, and then has a salvage or cull value in the end. Producers make this investment requiring some reasonable return over the course of that cow's productive life. Put simply, current profit levels matter, but long-term profit expectations are what really drive the expansion decision.

Profit Expectations get "Bid-into" Breeding Stock Values

In additional to the overall strength of the cattle market, another factor driving heifer values involves the capitalization of assets. While it is true that breeding stock is a long term capital investment, it is also true that the value of breeding stock is heavily influenced by profitability expectations. When profitability in the cow-calf sector increases, so does the cost of replacement females (and mature cows), as those heifers are likely to yield a greater positive cash flow over their productive lives.

This is an additional reason why bred heifers are selling for so much more today than they were 5 years ago. The related impact on heifer calf values also has the potential to stall expansion as those heifers calves increase in value. The first expense of heifer retention is the value of the heifer that is not sold at weaning time.

Greater Risk Leads to Greater Return Requirements

Since breeding stock represent a long-term investment, producers expand with an expectation of a positive return on this investment. Just like any other investment, producers will compare this expected return to that of other investments such as other farm enterprises, mutual funds, stocks, bonds, CDs, etc.

They will choose to invest in their cow herd when the expected return reaches a suitable level for the amount of risk they perceive. Most producers perceive greater risk in livestock production than was present 10-20 years ago as they have dealt with a lot of variability in both cattle and input prices. Higher perceived risk means that producers are likely to have higher return requirements for the next expansion phase than they did the previous one.

Cattle Compete With Other Land Uses

The last few years have done an excellent job illustrating a basic economic principle - units of production are allocated to their most profitable use. In many states like Kentucky, we have historically run cattle and produced hay on ground that was suitable for row crop production. As the expected profitability of corn and soybean production increased over the last several years, much of this land has become increasingly attractive to grain crop producers.

The result has been an increase in land rents (and land values), to levels that cattle production simply cannot compete with in many areas of the state. As a result, many of these acres were placed into row-crop production.

It's Easier to Covert Pasture to Row Crops than Vice-Versa

Many have also speculated that as grain prices decrease and grain profitability declines, we will see conversion of row crops back into pasture. This is likely an oversimplification. While many of these acres came out of pasture pretty quickly, we are not likely to see them return with comparable speed. Pastures can be plowed under or burned down, planted in corn or beans, and harvested for grain within a growing season.

However, re-establishing forages takes more time. Also, land rents tend to be sticky and are unlikely to fall drastically in the next few years. Grain producers are still likely to be able to pay more than cattle producers for that ground, even at $4-$5 / bu corn, especially when re-establishment costs and timing are considered.

This potential for conversion is even more complicated when one considers capital investments required. As land was being converted from pasture to row crop production, in some cases the fences were removed. Once those fences are gone, the cost of returning that land to pasture has been drastically increased. Much like breeding stock, fencing is an expensive, long term investment, that will only be made when investment in cattle and fencing is well justified by the market.

Profit Can't Make it Rain

Despite the attention given to loss of pasture ground to row crops, the single biggest factor that has driven the recent decrease in cattle numbers at the national level has probably been weather. Over the last ten years, most major cattle producing areas have dealt with drought at some point. At the time of this writing (April 2014), the Southern Plains (especially Texas) were coming off three very challenging weather years and much of the Western part of the US is under severe drought. Most cattle producing areas of the US have dealt with drought in recent years which has impacted their carrying capacity, forced them to sell off breeding stock, and increased production cost for remaining inventory.

There are Areas that Would Like to Expand, Weather Permitting

Given that so many areas were forced to reduce numbers recently, it is very likely that there will be interest in rebuilding in those areas once weather conditions improve. The best example is the Southern Plains where beef cow numbers in Texas are down 22 per cent from 2011 to 2014, and where much of this ground is probably not well suited to row crop production. While expansion has begun in some areas, it is very likely that other areas will follow suit when weather allows.

We Might Could Expand Fairly Quickly in the Early Stages

While heifer retention gets a lot of attention dealing with expansion, another factor worth consideration deals with the impact of the deep culling that we have seen in much of the US. We have actually seen increased heifer retention over the last several years, but this has not been enough to offset the reduction in beef cow numbers brought about by higher than normal culling. As the herd shrinks, it tends to be less productive and older cows that are culled first. This culling pattern has also likely been amplified by extremely high cull cow prices.

Put simply, higher cull cow prices will tend to encourage producers to cull cows sooner, rather than later. Given these culling patterns, it is likely that the average age of the US cow herd has decreased slightly over the past few years. If true, culling rates are likely to be lower once expansion begins. If decreased culling is combined with increase heifer retention, expansion may be more rapid that would have been expected.

Do We Have Farmers/Ranchers to Expand the Herd?

The previous discussion so far has assumed that farmers/ranchers are there at the ready to expand when conditions improve. However, there is growing concern that fewer and fewer of the next generation are willing to take on the challenges and opportunities of raising cattle.

It is relatively easier for fewer grain farmers to get bigger to make up for fewer numbers compared to cattle farmers. One of the main reasons for this deals with renting land that is scattered and non-contiguous. The additional management cost of farming two hundred acres in four parcels vs. one parcel is reasonably low for a grain farmer.

For a cattle farmer, it will involve almost four times as much work. It takes almost the same amount of time to check on 25 cows compared to 100 cows in one location. Grain farmers only spend a few days on each parcel of land each year, while cattle farmers need to be out there every week. This dynamic makes is difficult for cattle farmers to rent multiple tracks that are not contiguous. In most of the US, land tends to be broken into smaller parcels over time, further exacerbating this problem. The end result of fewer cattle farmers coming up through the ranks and a decrease in large tracks of land suitable for cattle will make it more difficult to expand the cattle herd in the future.