Beef: World Markets and Trade

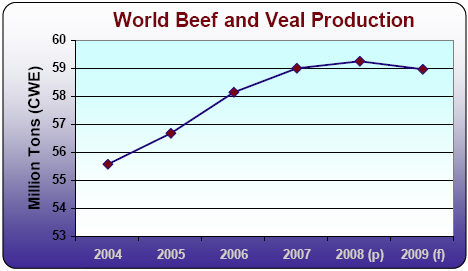

For the first time in 9 years, global production is forecast to fall albeit less than 1 per cent (295,000 tons) as modest increases in Brazil, China and India were more than offset by declines in the EU-27, Argentina, Australia and Russia, reports the United States Department of Agriculture Foreign Agricultural Service.World beef and veal production stable at 59.0 million tons

Brazil: Rebounding from the first drop in eleven years, production is expected to grow 190,000 tons (2 percent). The boost is forecast to be driven by resilient export demand, increased availability of cattle for slaughter, and continued stalwart domestic consumption bolstered by rising purchasing power. Higher production costs as well as elevated beef prices constrain more robust growth.

China: Production is forecast to surge nearly 2 percent to almost 6.4 million tons, albeit a slowdown from growth in 2008 as calf production is diminished due to lower profits. Pressure from escalating input prices (feed grain, fuel, water, electricity, and labor) are expected to stifle a more aggressive growth rate.

India: Production is expected to ascend a healthy 5 percent (135,000 tons) to nearly 2.8 million tons. While exports are foreseen to remain solid, the bulk of the expansion is driven by increasing domestic consumption. The cattle herd is forecast to continue to contract as cow stocks subside although buffalo stocks continue to advance. The upsurge in buffalo’s popularity stems from its diverse utility as a milk and meat producer in addition to its capacity as a draft animal. Further, buffalo meat consumption is fueled by its lack of a religious taboo which suppresses cow beef and pork consumption. Moreover, demand for buffalo meat is gradually growing in export markets due to its price competitiveness, perceived organic nature, and proportionally less fat.

EU-27: Production is forecast to remain sluggish at nearly 8.2 million tons. The EU-27 cattle herd is expected to continue to contract and slaughter will wane further.

Australia: Production is expected to fall over 1 percent to nearly 2.1 million tons as the supply of cattle for slaughter is reduced. Improved pasture conditions will encourage producers to hold back cattle for herd rebuilding.

Russia: Continuing its downward trend, Russian production is forecast to decline over 2 percent to 1.3 million tons as low productivity and reproductive inefficiency continue to plague the sector.

Exports: Modest recovery after a stagnant year

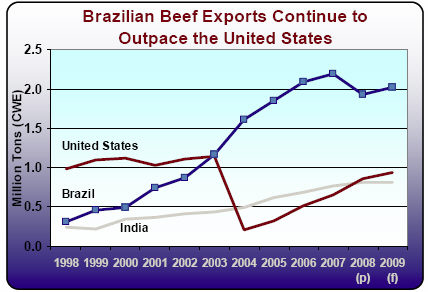

Exports are forecast to rise nearly 2 percent as gains by Brazil, Argentina and the United States outweigh downturns in Australian and New Zealand shipments.

Brazil: Exports for the world’s leading trader are forecast to spring back nearly 5 percent to over 2.0 million tons. Shipments are projected to decline in 2008 for the first time since 1996. However, by overcoming sanitary barriers, it is now poised to regain sales to Chile, EU-27 and other key markets. Continuing restrictions on imports by the EU-27 and high export prices prevent a more optimistic forecast.

Argentina: Exports are forecast to expand 20 percent to 480,000 tons in 2009 after plummeting an expected 25 percent in 2008. The rebound stems from the Argentine government setting a higher export quota, cattle and beef supplies not expected to be limited by farmer strikes, and thermoprocessed product to be exported outside of the quota.

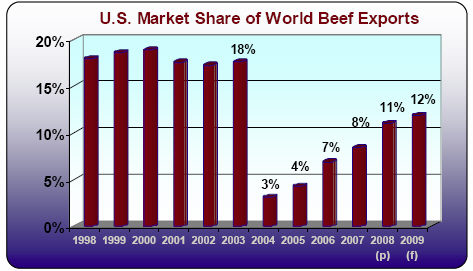

United States: The United States continues to rebound from trade restrictions due BSE (Bovine Spongiform Encephalopathy). While currently nearly half of shipments are currently to Canada and Mexico, opportunities are expanding in Asian markets and thus exports are forecast to accelerate nearly 10 percent.

An agreement was concluded with South Korea on April 18, 2008 to fully reopen the market to all U.S. beef and beef products consistent with international standards and the World Organization for Animal Health (OIE) guidelines. However, in response to significant public outcry in Korea, in part fueled by misinformation regarding the resumption of U.S. beef, Korean importers and U.S. exporters reached a commercial understanding that only U.S. beef from cattle under 30 months of age will be shipped to Korea, as a transitional measure, until Korean consumer confidence in U.S. beef improves. While U.S. beef is being sold at small butcher shops, large discount chain stores have not yet decided to sell U.S. beef. Once these stores make that decision, the pace of imports will pick up and more chilled beef will be exported. Currently, almost all imports of U.S. beef have been frozen beef shipped via sea. In 2003, approximately 15 percent of U.S. beef exported to Korea was fresh/chilled.

Australia: Trade is forecast to fall about 3 percent due to lower production that reduces exportable supplies and escalating competition in Japanese and Korean markets from the United States. Resilient domestic demand also puts downward pressure on exports.

New Zealand: Reduced production and stable domestic consumption are forecast to reduce exports by nearly 4 percent, with shipments to Korea and Japan expected to be trimmed by growing competition from the United States. However, the composition of exports is forecast to start reflecting a higher percentage of manufacturing beef and thus shipments to the United States could reverse their downward trend.

Imports: Rising largely due to the United States

Stronger demand from major importers such as the United States, Russia, Japan, the EU-27 and Korea is expected to more than offset slightly lower demand from Mexico, Venezuela and the Philippines. United States: The United States accounts for the lion’s share of rising imports with a 7 percent (82,000 tons) boost in the forecast, fostered by a strengthening dollar, and reduced cow slaughter which tightens domestic manufacturing or processing beef supplies supplies.

Russia: Imports are forecast to rise 2 percent to over 1.0 million tons as production continues to wither, and climbing consumption will force imports to meet demand.

Japan: Despite a weakening economy, stable consumption partnered with declining production translates to expanding imports of over 2 percent in the forecast. While U.S. beef is available for purchase at over 10,000 restaurants and retail establishments in Japan, age limitations in the agreed bilateral trade protocol constrain available import supply.

Korea: Imports are expected to rise over 6 percent (20,000 tons) to 340,000 tons.

Further Reading

| - | You can view the full Livestock and Poultry World Markets and Trade report by clicking here. |

October 2008