Using, Not Buying, Livestock Gross Margin for Cattle

US - While visiting with agriculture bankers in recent weeks, several asked about feeding margins and what their customers could do to manage margins, writes Professor Matthew A. Diersen, Department of Economics, South Dakota State UniversityProtecting the margin is a common concern of cattle feeders too. One way to monitor the margin is to use the format from Livestock Gross Margin (LGM) insurance, writes Professor Diersen.

The margin in LGM acts like a “cattle crush”, where one sells live cattle and buys corn and feeder cattle. By tracking a specific margin, one can see its track record and decide if the margin is large enough to protect.

Some of you may recall the textbook advice to use selective hedging for livestock. The reason for selective hedging is that always hedging livestock in a feeding setting will result in returns similar to always being in the cash market.

Consider the LGM margin for yearlings that are six months from marketing as fed cattle. In November, that expected margin coverage would have reflected a 1250 pound steer to be sold in May of 2014.

The expected margin would have been what was left over after buying a 750 pound steer in December of 2013 and 50 bushels of corn in March of 2014. There is a formula that takes futures prices of either the contracts for those months or their surrounding months.

In November, that expected margin was $181 per head, down from $207 per head in October. The actual margin will be computed based on the eventual feeder prices in a few months, corn at the end of March, and live cattle in six months. If a producer had purchased LGM in November, that is the margin covered and any combination of live cattle futures decreasing and corn or feeder cattle futures increasing would change the actual margin.

The 6-month expected margin is stable relative to the actual margin. The expected margin has averaged $164 per head over the past five years.

That would also represent normal returns before non-corn feed costs. The expected margin has stayed above $100 per head since early in 2009. It has only exceeded $230 per head a couple of times – in early 2008 and again in August of 2013.

The actual margin has much greater variability. The actual margin has turned negative a few times, in 2008 and 2012. Thus, cattle feeders would not have begun to cover variable costs during those stretches on unprotected cattle.

However, being fully hedged all the time would have cost feeders the several times the actual margin has exceeded $300 per head, reaching a record level last month of $379 per head.

In a competitive environment, one would not expect very high or very low expected margins to last very long. One could monitor the expected margin. When it exceeds the average level, then protection could be considered. The trend, currently lower, could also be monitored as a signal to place protection before the margin becomes too low.

The expected and actual margin can be monitored on the Risk Management Agency website: www.rma.usda.gov. Details about LGM are available there also. Admittedly, LGM is not popular for cattle.

So far in fiscal year 2014 only 250 head have been covered, up from 135 head in fiscal year 2013. If the volatility in the market were very high – making option protection on live cattle and/or corn expensive – then LGM can be cost-effective. To monitor the cost of premiums, the site: www.iaii.us can be used.

The Markets

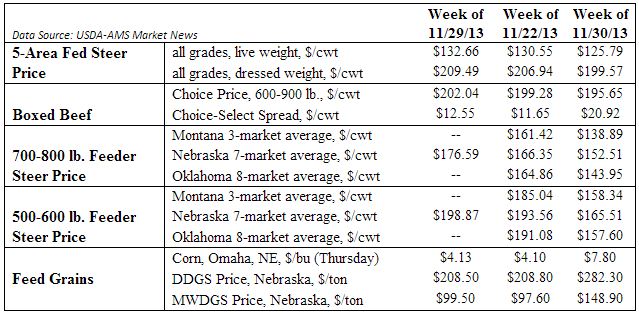

The cattle feeding margin was little changed for the week. The fed cattle and feeder cattle prices were mostly higher and while corn was steady at the end of harvest.

TheCattleSite News Desk