USDA Cattle on Feed Even More Bullish than Expected

ANALYSIS - Friday's Cattle on Feed report came in even a little more bullish than expected, according to analysts at Allendale Inc.

Feedlots have not made money in over two years; they are waiting for feed prices to continue their descent. And perhaps a few backgrounds scooped numbers up for a quick fall visit to pastures. The other possibility that must be discussed is the potential that some heifer retention is being seen. That will be confirmed in a few more weeks.

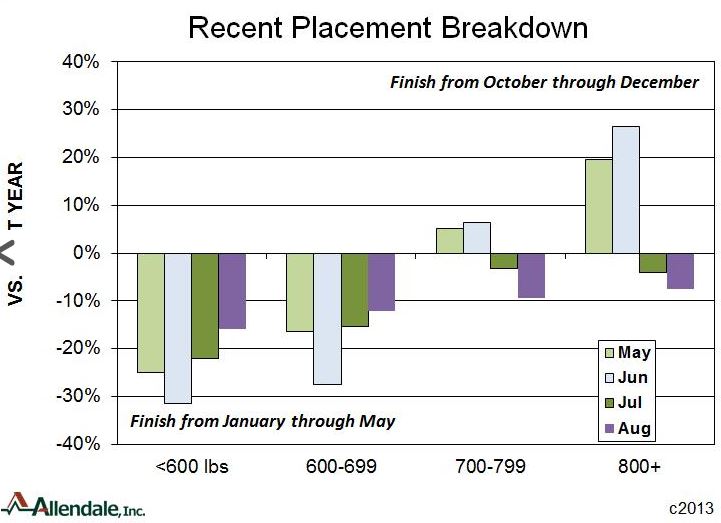

In the big picture, we now have four months in a row of low placement numbers. We now have monthly cattle slaughter estimates known through January. January cattle slaughter comes from placements in May of under 600 lb, June of the 600-699 lbs, July of the 600-699 and 700-799 lbs, and August 700-799/800+.

Here’s the breakdown of those specific categories vs. previous year: -25 per cent , -28 per cent , -3 per cent /-15 per cent , and -8 per cent /-9 per cent . The range of each category of Placements that will make up February slaughter is: -32 per cent , -15 per cent , and -9 per cent . Though we don’t have one category here, September 800+ feeders, that won’t change the net message.

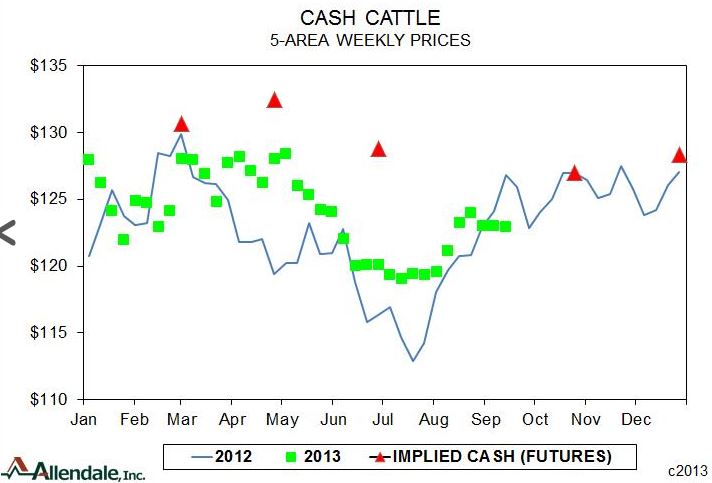

February 2014 futures are implying cash at $131. This past February cash cattle ended at $128. So we are looking at a few weeks of slaughter 8 per cent to 10 per cent lower than last year and futures have a $3 premium? We hold to our February futures projection of $140.

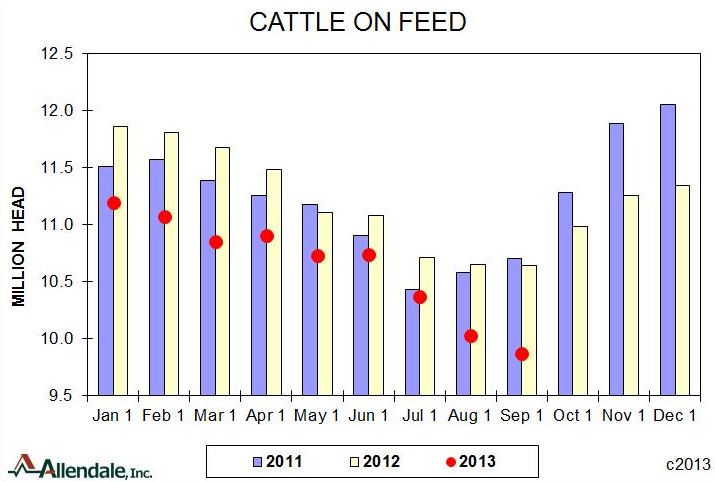

August Marketings, the number fat cattle that have finished their 3 to 8 month feeding period, were 3.7 per cent smaller than last year. That is actually better than expected. Keep in mind this Marketing number was artificially low by 3.6 per cent as August had one less weekday/one more Saturday than in 2012. As a whole, the feedlot population fell from 5.9 per cent smaller than last year on August 1 to now 7.2 per cent smaller than last year on September 1.

TheCropSite News Desk