LMC: Value of Northern Ireland's Meat Sales Increasing

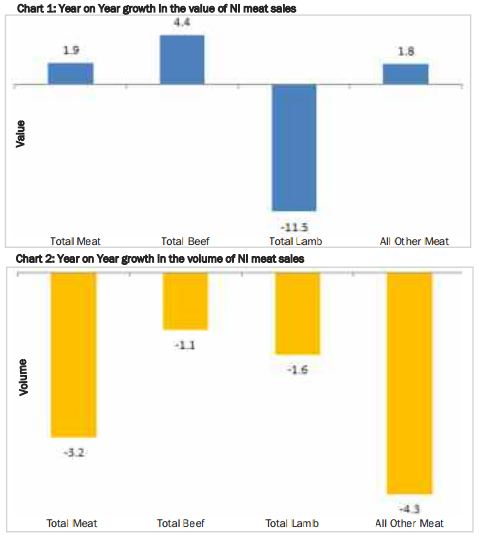

NORTHERN IRELAND - The horsemeat scandal and subsequent rising beef retail prices has not pegged back demand for Irish beef, Livestock and Meat Commission analysts say.Kantar consumer data for Northern Ireland for the year ending the 9 June 2013 has indicated a 1.9 per cent growth in the value of total meat sales year on year, write LMC experts. This is despite a 3.2 per cent drop in the total volume of meat sold.

All meat sectors have shown a volume decline year on year. The growth recorded in the value of total meat sales has been driven primarily by a four per cent growth in the value of beef sales. this increase in value has occurred due to an increase in retail beef prices as opposed to any growth in the volume of beef sold, which actually declined by 1 per cent year on year as indicated in chart 2.

The value of sales of lamb in NI during the 52 weeks ending the 9 June 2013 declined by 11.5 per cent year on year with a 1.6 per cent reduction in the volume of lamb sold recorded year on year.

Meanwhile the value of all other meat sales increased by 1.8 per cent despite a 4.3 per cent reduction in the volume of other meats sold, say Livestock and Meat Commission analysts.

With the market share ofthe othermeats category remaining steady 58.1 per cent the growth in the value of beef sales has occurred atthe expense of lamb. Beef market share has increased by one per cent year on year to account for 36.8 per cent of total meat sales.

Lamb’s share of the total meat market in NI during the 52 weeks ending the 9 June 2013was 5.1 per cent compared to 5.9 per cent during the corresponding period the previous year.

The number of NI households buying lamb has also shown a decline year on year with a household penetration in the year ending 9 June 2013 of 44.6 per cent compared to 50.1 per cent in the previous year. this drop in the number of households purchasing lamb has come about despite a drop in the average price per kilo from £8.09 to £7.28 accounting for a 10 per cent decline in the average retail price year on year.

This decline in the average price of lamb goes against the current trend for increasing meat retail prices with the average price of total meat sales up five per cent year on year. The retail price of all other meats (total meat sales minus beef and lamb) increased by 6 per cent when comparing the two periods.

With retail lamb sales in NI struggling despite the notable drop in the average retail price the spend per buyer per year on lamb has decreased from £49.40in the 52 weeks ending the 10 June 2012 to £48.80 in the 52 weeks ending 9 June 2013.

In contrast the Kantar figures for GB for the same period have shown that lamb sales have been performing strongly in comparison to other meats with expenditure up nine per cent year on year and volume sales up 16 per cent. This increase has been driven by strong promotions on leg roasting

joints by the major retailers.

Meanwhile, despite an increase in the average NI retail price of beef from £6.90 to £7.28 year on year(+5.5per cent), the proportion of households buying beef has grown year on year. In the year ending the 9 June 2013 household penetration for beef was 93.6 per cent in NI compared to 91.4

per cent the previous year. The increasing cost of beef or the issues raised by the recent horse meat

crisis do not appear to have discouraged NI consumers from purchasing beefwith the average spend per buyer increasing year on year from £165.90 to £168.10 (+1.3 per cent).

TheCattleSite News Desk