Opportunities For UK Offal

What are the export opportunities for UK offal, asked Dr Phil Hadley, South West Regional Manager for English Beef and Lamb Executive at Beef Expo 2010. Charlotte Johnston, TheCattleSite junior editor reports.There are huge international differences between the use of offal, or as it is otherwise known, the fifth quarter.

In Australia, the Netherlands, Germany, France and the US, its use is much more acceptable. Dr Hadley points out that the difference between Dutch and British fifth quarter value is £36.5 per head.

This equates to a theoretical loss of value to the UK beef sector of £96.5 million.

Dr Hadley explained that there were poor perceptions of offal in the UK, from processors to consumers.

The main issues are lost processor skills as well as the loss of infrastructure to handle offal.

This has meant that the UK has missed out on export markets, says Dr Hadley, who believes that the industry must invest in the skills and facilities needed.

"Instead offal has become a disposal issue, rather than a value issue."

Dr Hadley explained that British consumers have lost the taste and skills to prepare offals, whilst some offals have just not been available.

Rising living standards have meant that offals are consumed less, they are also not as cultural in the UK compared to other EU countries.

Another problem is that offal is often damaged, testing of the product by the Meat Hygiene Service often results in too many cuts in the product and large incisions, which devalue the product on the European markets.

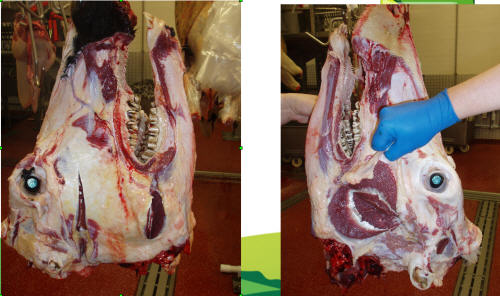

Image 1 shows the different incisions on a beef head. On the left hand picture, the cut is small and causes minimum damage, whilst the right hand side shows the whole cheek flesh exposed.

Opportunities

With beef offal prices increasing rapidly due to short supplies, there is a real opportunity, urged Dr Hadley.

The growing demand has been fuelled by the credit crunch, coupling this with a worldwide shortage, prices are been driven upwards.

Prices of US beef livers have tripled in recent years, as main buyers in Egypt and Russia battle over the short supply.

Between 2005 and 2008, the European tripe price tripled in value from 45 p/kg to 147 p/kg.

There is, in particular, growing demand from the eastern european countries, however it is growing elsewhere, thanks to the likes of celeb chefs and the increased popularity of traditional butchers.

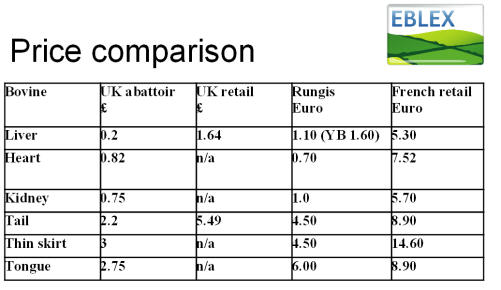

Table 1 shows the price mark ups that can be made when selling offal.

Dr Hadley says that it is important to look at increasing domestic interest and consumption. He says that offal is a nutritious, low cost food.

However, it is equally important to look at the European markets, and potential emerging markets in Africa and the Far East, he says.

Beef market in the UK

Dr Hadley said that we are 80 per cent self sufficient for beef in the UK, therefore imports are needed to satisfy demand of 17.4 kg/ head/ per annum.

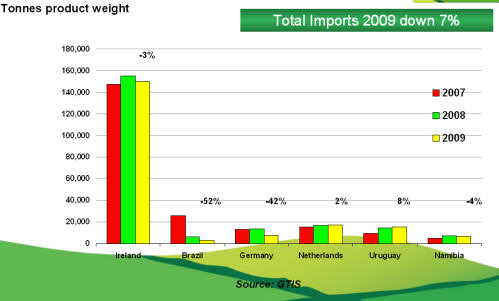

Figure 1 shows fresh/ frozen beef imports, which fell in 2009 by seven per cent.

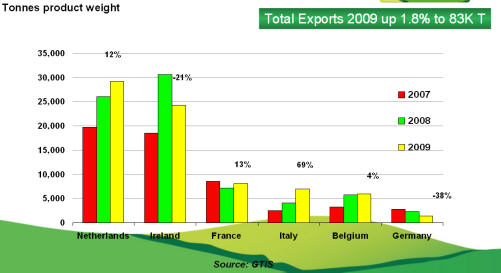

With regards to the export market, high value cuts tend to go to Italy, Belgium and Germany, with a market for cows in France. Ireland is also an important market, although exports fell in 2009. Cows and manufacturing beef go to the Netherlands, which is the biggest export market.

Figure 2 shows fresh and frozen beef exports, which in 2009 totalled 83,000 tonnes.

In conclusion, the meat industry must start to train processors in offal processing techniques, whilst marketing the products to the domestic and international markets.

August 2010